Dollar Tree 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

of credit is renewable annually. The letter of credit and

reimbursement agreement requires that we maintain

specified financial ratios and restricts our ability to

pay cash dividends.

Commitments

Letters of Credit and Surety Bonds. Effective March 12,

2001, we entered into a Letter of Credit Reimbursement

and Security Agreement, which provides $125.0 million

for letters of credit, which are generally issued for the

routine purchase of imported merchandise. Approximately

$88.9 million was committed to letters of credit at

January 29, 2005. We also have letters of credit or surety

bonds outstanding for our revenue bond financing, our

insurance programs and certain utility payment

obligations at some of our stores.

Freight Contracts. We have contracted outbound freight

services from various carriers with contracts expiring

through January 2007. The total amount of these

commitments is approximately $35.5 million.

Technology Assets. We have commitments totaling

approximately $5.8 million to primarily purchase store

technology assets for our stores during 2005.

Derivative Financial Instruments

We are party to two interest rate swaps, which allow us

to manage the risk associated with interest rate fluctuations

on the demand revenue bonds and a portion of our

revolving credit facility. The swaps are based on notional

amounts of $19.0 million and $25.0 million. Under the

$19.0 million agreement, as amended, we pay interest

to the bank that provided the swap at a fixed rate. In

exchange, the financial institution pays us at a variable-

interest rate, which is similar to the rate on the demand

revenue bonds. The variable-interest rate on the interest

rate swap is set monthly. No payments are made by

either party under the swap for monthly periods with an

established interest rate greater than a predetermined rate

(the knock-out rate). The swap may be canceled by the

bank or us and settled for the fair value of the swap as

determined by market rates.

The $25.0 million interest rate swap agreement is

used to manage the risk associated with interest rate

fluctuations on a portion of our revolving credit facility.

Under this agreement, we pay interest to a financial

institution at a fixed rate of 5.43%. In exchange, the

financial institution pays us at a variable-interest rate,

which approximates the floating rate on the debt,

excluding the credit spread. The interest rate on the swap

is subject to adjustment monthly. The swap is effective

through March 2006, but it may be canceled by the bank

or us and settled for the fair value of the swap as

determined by market rates.

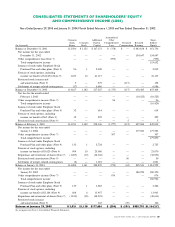

Because of the knock-out provision in the $19.0

million swap, changes in the fair value of that swap are

recorded in earnings. Changes in fair value on our $25.0

million interest rate swap are recorded as a component

of “accumulated other comprehensive income”in the

consolidated balance sheets because the swap qualifies

for hedge accounting treatment in accordance with

Statement of Financial Accounting Standards No. 133, as

amended by Statement of Financial Accounting Standards

No. 138. The amounts recorded in accumulated other

comprehensive income are subsequently reclassified into

earnings in the same period in which the related interest

affects earnings.

For more information on the interest rate swaps, see

“Quantitative and Qualitative Disclosures About Market

Risk – Interest Rate Risk.”

Critical Accounting Policies

The preparation of financial statements requires the use

of estimates. Certain of our estimates require a high level

of judgment and have the potential to have a material

effect on the financial statements if actual results vary

significantly from those estimates. Following is a

discussion of the estimates that we consider critical.

Inventory Valuation

As discussed in Note 1 to the Consolidated Financial

Statements, inventories at the distribution centers are

stated at the lower of cost or market with cost determined

on a weighted-average basis. Cost is assigned to store

inventories using the retail inventory method on a

weighted-average basis. Under the retail inventory

method, the valuation of inventories at cost and the

resulting gross margins are computed by applying a

calculated cost-to-retail ratio to the retail value of

MANAGEMENT’S DISCUSSION & ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS