Dollar Tree 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

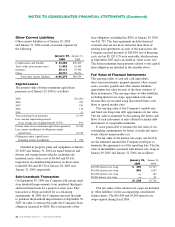

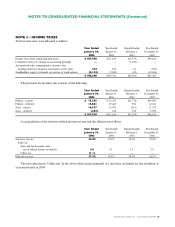

Other Current Liabilities

Other current liabilities as of January 29, 2005

and January 31, 2004 consist of accrued expenses for

the following:

January 29, January 31,

2005 2004

Compensation and benefits $ 23,384 $25,435

Taxes (other than income taxes) 11,992 10,450

Insurance 29,112 25,398

Other 40,791 28,676

Total other current liabilities $105,279 $89,959

Capital Leases

The present value of future minimum capital lease

payments as of January 29, 2005 is as follows:

2005 $13,081

2006 279

2007 183

2008 115

2009 51

Total minimum lease payments 13,709

Less: amount representing interest

(at an average rate of approximately 10.9%) 963

Present value of net minimum capital lease payments 12,746

Less current installments of obligations under

capital leases 12,212

Obligations under capital leases,

excluding current installments $ 534

Included in property, plant and equipment at January

29, 2005 and January 31, 2004 are leased furniture and

fixtures and transportation vehicles, excluding sale-

leaseback assets, with a cost of $4,465 and $5,641,

respectively. Accumulated depreciation on these assets

totaled $2,964 and $3,370 at January 29, 2005 and

January 31, 2004, respectively.

Sale-Leaseback Transaction

On September 30, 1999, the Company sold certain retail

store leasehold improvements to an unrelated third party

and leased them back for a period of seven years. This

transaction is being accounted for as a financing

arrangement. In 2004, the Company exercised the right

to purchase the leasehold improvements at September 30,

2005. In order to exercise this right, the Company’s lease

obligation increased by $200. The total amount of the

lease obligation, including this $200, at January 29, 2005

was $11,735. The lease agreement includes financial

covenants that are not more restrictive than those of

existing loan agreements. As part of the transaction, the

Company received proceeds of $20,880, net of financing

costs, and an $8,120 11% note receivable, which matures

in September 2005 and is included in “other assets, net.”

The future minimum lease payments related to the capital

lease obligation are included in the schedule above.

Fair Value of Financial Instruments

The carrying values of cash and cash equivalents,

short-term investments, prepaid expenses, other current

assets, accounts payable and other current liabilities

approximate fair value because of the short maturity of

these instruments. The carrying values of other liabilities,

excluding interest rate swaps, approximate fair value

because they are recorded using discounted future cash

flows or quoted market rates.

The carrying value of the Company’s variable-rate

and fixed-rate long-term debt approximates its fair value.

The fair value is estimated by discounting the future cash

flows of each instrument at rates offered for similar debt

instruments of comparable maturities.

It is not practicable to estimate the fair value of our

outstanding commitments for letters of credit and surety

bonds without unreasonable cost.

The fair value of the interest rate swaps (see Note 6)

are the estimated amounts the Company would pay to

terminate the agreements as of the reporting date. The fair

value of the liabilities associated with interest rate swaps at

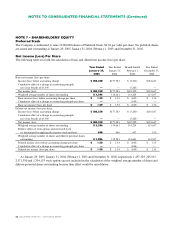

January 29, 2005 and January 31, 2004, are as follows:

January 29, January 31,

2005 2004

$25,000 interest rate swap $ 655 $1,767

$19,000 interest rate swap 893 1,687

$10,000 interest rate swap —183

$5,000 interest rate swap —81

$1,548 $3,718

The fair values of the interest rate swaps are included

in “other liabilities”in the accompanying consolidated

balance sheets. The $10,000 and $5,000 interest rate

swaps expired during fiscal 2004.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)