Dollar Tree 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 45

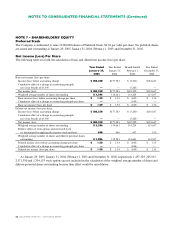

The 2003 Non-Employee Director Stock Option

Plan provides non-qualified stock options to non-

employee members of the Company’s Board of Directors.

The stock options are functionally equivalent to such

options issued under the EIP discussed above. The

exercise price of each stock option granted equals the

market price of the Company’s stock at the date of grant.

The options generally vest immediately.

The 2003 Director Deferred Compensation Plan

permits any of the Company’s directors who receive a

retainer or other fees for Board or committee service to

defer all or a portion of such fees until a future date, at

which time they may be paid in cash or shares of the

Company’s common stock, or to receive all or a portion

of such fees in non-statutory stock options. Deferred fees

that are paid out in cash will earn interest at the 30-year

Treasury Bond Rate. If a director elects to be paid in

common stock, the number of shares will be determined

by dividing the deferred fee amount by the current

market price of a share of the Company’s common

stock. The number of options issued to a director will

equal the deferred fee amount divided by 33% of the

price of a share of the Company’s common stock. The

exercise price will equal the fair market value of the

Company’s common stock at the date the option was

issued. The options are fully vested when issued and

have a term of 10 years.

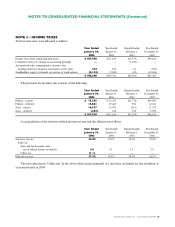

The fair value of each option grant is estimated on

the date of grant using the Black-Scholes option-pricing

model with the following weighted average assumptions:

Fiscal Fiscal Fiscal

2004 2003 2002

Expected term in years 5.3 5.4 5.7

Expected volatility 59.8% 60.7% 63.8%

Annual dividend yield ———

Risk free interest rate 3.7% 3.4% 3.0%

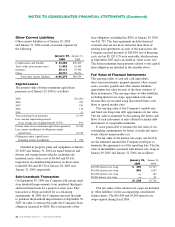

The following tables summarize the Company’s various option plans as of January 29, 2005, January 31, 2004,

February 1, 2003 and December 31, 2002 and for the years ended January 29, 2005 and January 31, 2004, the month

ended February 1, 2003, and the year ended December 31, 2002, and information about fixed options outstanding at

January 29, 2005:

Stock Option Activity

January 29, 2005 January 31, 2004 February 1, 2003 December 31, 2002

Weighted Weighted Weighted Weighted

Average Average Average Average

Per Share Per Share Per Share Per Share

Exercise Exercise Exercise Exercise

Shares Price Shares Price Shares Price Shares Price

Outstanding, beginning of period 6,007,471 $23.81 5,414,023 $24.19 5,440,547 $24.17 5,683,827 $20.39

Granted 1,682,572 25.52 1,904,057 20.54 6,000 25.26 1,723,000 31.54

Exercised (608,432) 19.58 (993,841) 19.57 (12,402) 12.93 (1,632,942) 18.64

Forfeited (534,192) 25.90 (316,768) 24.01 (20,122) 25.89 (333,338) 25.02

Outstanding, end of period 6,547,419 24.47 6,007,471 23.81 5,414,023 24.19 5,440,547 24.17

Options exercisable at end of period 3,282,102 24.52 2,649,188 24.31 2,340,921 21.84 2,343,879 21.77

Weighted average fair value of options

granted during the period $14.27 $17.08 $15.24 $18.66

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)