BP 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

Other provisions and liabilities are recognized in the period when it

becomes probable that there will be a future outflow of funds resulting

from past operations or events and the amount of cash outflow can be

reliably estimated. The timing of recognition and quantification of the

liability require the application of judgement to existing facts and

circumstances, which can be subject to change. Since the actual cash

outflows can take place many years in the future, the carrying amounts

of provisions and liabilities are reviewed regularly and adjusted to take

account of changing facts and circumstances.

A change in estimate of a recognized provision or liability would

result in a charge or credit to net income in the period in which the

change occurs (with the exception of decommissioning costs as

described above).

Provisions for environmental remediation are made when a clean-

up is probable and the amount of the obligation can be reliably estimated.

Generally, this coincides with commitment to a formal plan of action or, if

earlier, on divestment or on closure of inactive sites. The provision for

environmental liabilities is estimated based on current legal and

constructive requirements, technology, price levels and expected plans

for remediation. Actual costs and cash outflows can differ from estimates

because of changes in laws and regulations, public expectations, prices,

discovery and analysis of site conditions and changes in clean-up

technology.

The provision for environmental liabilities is reviewed at least

annually. The interest rate used to determine the balance sheet obligation

at 31 December 2009 was 1.75% (2008 2%).

As further described in Financial statements – Note 41 on

page 176, the group is subject to claims and actions. The facts and

circumstances relating to particular cases are evaluated regularly in

determining whether it is probable that there will be a future outflow of

funds and, once established, whether a provision relating to a specific

litigation should be adjusted. Accordingly, significant management

judgement relating to contingent liabilities is required, since the outcome

of litigation is difficult to predict.

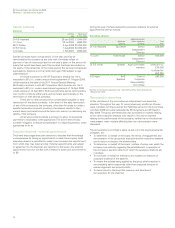

Pensions and other post-retirement benefits

Accounting for pensions and other post-retirement benefits involves

judgement about uncertain events, including estimated retirement dates,

salary levels at retirement, mortality rates, rates of return on plan assets,

determination of discount rates for measuring plan obligations, healthcare

cost trend rates and rates of utilization of healthcare services by retirees.

These assumptions are based on the environment in each country.

Determination of the projected benefit obligations for the group’s defined

benefit pension and post-retirement plans is important to the recorded

amounts for such obligations on the balance sheet and to the amount of

benefit expense in the income statement. The assumptions used may

vary from year to year, which will affect future results of operations.

Any differences between these assumptions and the actual outcome

also affect future results of operations.

Pension and other post-retirement benefit assumptions are

reviewed by management at the end of each year. These assumptions

are used to determine the projected benefit obligation at the year-end

and hence the surpluses and deficits recorded on the group’s balance

sheet, and pension and other post-retirement benefit expense for the

following year.

The pension and other post-retirement benefit assumptions at

December 2009, 2008 and 2007 are provided in Financial statements –

Note 35 on page 161.

The assumed rate of investment return, discount rate and the

US healthcare cost trend rate have a significant effect on the amounts

reported. A sensitivity analysis of the impact of changes in these

assumptions on the benefit expense and obligation is provided in

Financial statements – Note 35 on page 161.

In addition to the financial assumptions, we regularly review the

demographic and mortality assumptions. Mortality assumptions reflect

best practice in the countries in which we provide pensions and have

been chosen with regard to the latest available published tables adjusted

where appropriate to reflect the experience of the group and an

extrapolation of past longevity improvements into the future. A sensitivity

analysis of the impact of changes in the mortality assumptions on the

benefit expense and obligation is provided in Financial statements –

Note 35 on page 161.

Property, plants and equipment

BP has freehold and leasehold interests in real estate in numerous

countries, but no individual property is significant to the group as a

whole. See Exploration and Production on page 22 for a description of

the group’s significant reserves and sources of crude oil and natural gas.

Significant plans to construct, expand or improve specific facilities are

described under each of the business headings within this section.

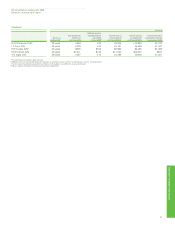

Share ownership

Directors and senior management

As at 18 February 2010, the following directors of BP p.l.c. held interests in BP ordinary shares of 25 cents each or their calculated equivalent as set

out below:

I C Conn 349,820 2,016,005a266,904b

R W Dudley 276,846 1,120,716a–

Dr B E Grote 1,351,529 2,376,570a–

Dr A B Hayward 622,807 3,022,598a–

A G Inglis 308,639 2,016,005a266,904b

P Anderson 6,000 – –

A Burgmans 10,156 – –

C B Carroll 10,500 – –

Sir William Castell 82,500 – –

G David 39,000 – –

E B Davis, Jr 76,497 – –

D J Flint 15,000 – –

Dr D S Julius 15,000 – –

Sir Ian Prosser 16,301 – –

C-H Svanberg 750,000 – –

aPerformance shares awarded under the BP Executive Directors’ Incentive Plan. These figures represent the maximum possible vesting levels. The actual number of shares/ADSs that vest will depend on

the extent to which performance conditions have been satisfied over a three-year period.

bRestricted share award under the BP Executive Directors’ Incentive Plan. These shares will vest in two equal tranches after three and five years, subject to the directors’ continued service and satisfactory

performance.

BP Annual Report and Accounts 2009

Additional information for shareholders