BP 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

BP Annual Report and Accounts 2009

Business review

Business review

Business review

Biofuels

BP has a key role to play in enabling the transport sector to respond to

the dual challenges of energy security and climate change. We have

embarked on a focused programme of biofuels development based

around the most efficient transformation of sustainable and low-cost

sugars into a range of fuel molecules. BP continues to invest throughout

the entire biofuels value chain from sustainable feedstocks that minimize

pressure on food supplies through to the development of the advantaged

fuel molecule biobutanol. BP has production facilities operating, or in the

planning and construction phases, in the US, Brazil and the UK.

In 2009, we announced a $45-million investment in a joint

venture with Verenium which plans to construct a facility to produce

lignocellulosic bioethanol in Florida, US. This investment builds on the

$90-million investment made by BP in 2008 to further develop existing

Verenium technical work and develop a demonstration plant at

commercial scale. In August, BP also announced a $10-million multi-year

agreement with Martek Biosciences Corporation to establish proof of

concept for large-scale microbial biodiesel production through the

fermentation of sugars.

The blending and distribution of biofuels continues to be carried

out by our Refining and Marketing segment, in line with regulation. BP is

one of the largest blenders and marketers of biofuels in the world.

Wind

In wind power, BP has focused its portfolio in the US, where we believe

the most attractive opportunities exist and where we have developed

one of the leading wind portfolios.

During 2009, we announced the completion of phase I of the

100MW Flat Ridge Wind Farm in Barber County, Kansas. BP and Westar

Energy, Inc. each own 50% of phase 1 of the wind farm. BP sells its

share of the output to Westar. In addition, commercial operations

commenced at the Fowler Ridge Wind Farm in Benton County, Indiana,

the largest wind farm in the US Midwest at 600MW, where BP and

Dominion are equal partners in 300MW. BP and Sempra Generation are

equal partners in 200MW, and 100MW is wholly-owned by BP. Full

commercial operation also began at our wholly-owned 25MW Titan I

Wind Farm in South Dakota.

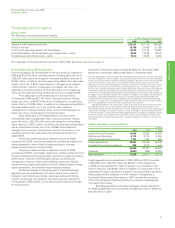

As a result, BP has increased its net wind generation capacity to

711MW during 2009, an increase of 65% over the prior year. This net

increase in capacity includes the disposal of 78MW of our wind interests

in India as part of our focus on US wind.

Solar

2009 was quite challenging in the solar market due to weak demand in

the first half year and a significant decrease in module sales prices of

about 40%. However, BP Solar was successful in increasing unit sales

by 41MW to 203MW, an increase of 25% over 2008.

BP Solar’s organization, with over 1,700 employees worldwide,

is headquartered in San Francisco, California, in the US. BP Solar is

structured to serve the residential, commercial, and utility markets with

sales and marketing offices in major markets around the world. Our

manufacturing facilities are located in Frederick, Maryland, US; and joint

venture manufacturing is located in Xi’an, China and Bangalore, Indiaa.

During 2009, BP Solar continued to restructure manufacturing to

reduce costs and, as part of this programme, module assembly was

phased out in Maryland and our cell manufacture and module assembly

facilities in Madrid, Spain, were closed. Wafer and cell manufacturing

facilities in Maryland and joint venture manufacturing sites in China and

India continue to supply BP Solar.

aOur Indian manufacturing operations are accounted for as a consolidated subsidiary.

Hydrogen power and CCS

BP has played a leading role in the CCS industry for more than 10 years,

and today focuses on both full-scale projects and a continuing

programme of research and technology development. The Hydrogen

Energy International Limited joint venture, which was formed to develop

hydrogen power projects in 2007, is now wholly owned by BP following

an agreement with Rio Tinto to sell its 50% share.

The two companies are continuing to develop the Hydrogen

Energy California 250MW power project with CCS through the

Hydrogen Energy International LLC joint venture, which secured

$308 million of Department of Energy (DoE) funding during 2009.

The funding award was made to California as part of the American

Recovery Reinvestment Act of 2009 and is part of the third round of

the DoE’s Clean Coal Power Initiative.

Separately, the 400MW Hydrogen Power Abu Dhabi project with

CCS reached an important milestone, with the Abu Dhabi environmental

regulator’s approval of the environment and social impact assessment.

The project is a joint venture between BP (40%) and Masdar (60%).

Shipping

We transport our products across oceans, around coastlines and along

waterways, using a combination of BP-operated, time-chartered and

spot-chartered vessels. All vessels conducting BP activities are subject

to our health, safety, security and environmental requirements. The

primary purpose of our shipping and chartering activities is the

transportation of our hydrocarbon products. In addition, we may use

surplus capacity to transport third-party products.

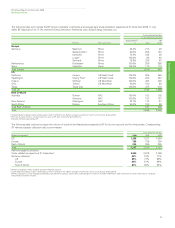

International fleet

The size of our managed international fleet has not changed since 2008.

At the end of 2009, we had 54 international vessels (37 medium-size

crude and product carriers, four very large crude carriers, one North Sea

shuttle tanker, eight LNG carriers and four LPG carriers). All these ships

are double-hulled. Of the eight LNG carriers, BP manages one on behalf

of a joint venture in which it is a participant and operates seven LNG

carriers.

Regional and specialist vessels

In Alaska, we retain a fleet of four double-hulled vessels. Outside the

US, we had 14 specialist vessels (two double-hulled lubricants oil barges

and 12 offshore support vessels).

Time-charter vessels

BP has 104 hydrocarbon-carrying vessels above 600 deadweight tonnes

on time-charter, of which 102 are double-hulled. All these vessels

participate in BP’s Time Charter Assurance Programme.

Spot-charter vessels

BP spot-charters vessels, typically for single voyages. These vessels are

always vetted for safety assurance prior to use.

Other vessels

BP uses various craft such as tugs, crew boats and seismic vessels in

support of the group’s business. We also use sub-600 deadweight tonne

barges to carry hydrocarbons on inland waterways.