BP 2009 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147

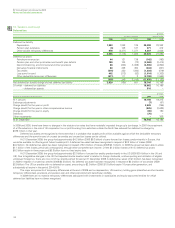

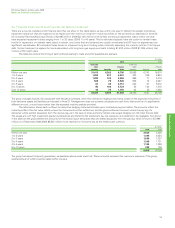

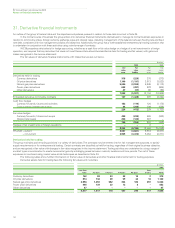

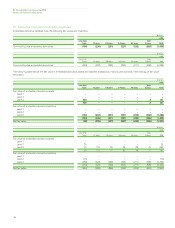

24. Financial instruments and financial risk factors continued

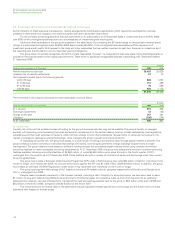

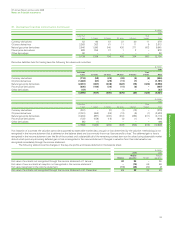

The group’s earnings are sensitive to changes in interest rates on the floating rate element of the group’s finance debt. If the interest rates

applicable to floating rate instruments were to have increased by 1% on 1 January 2010, it is estimated that the group’s profit before taxation for

2010 would decrease by approximately $219 million (2008 $239 million decrease in 2009). This assumes that the amount and mix of fixed and

floating rate debt, including finance leases, remains unchanged from that in place at 31 December 2009 and that the change in interest rates is

effective from the beginning of the year. Where the interest rate applicable to an instrument is reset during a quarter it is assumed that this occurs

at the beginning of the quarter and remains unchanged for the rest of the year. In reality, the fixed/floating rate mix will fluctuate over the year and

interest rates will change continually. Furthermore, the effect on earnings shown by this analysis does not consider the effect of any other changes

in general economic activity that may accompany such an increase in interest rates.

(iv) Equity price risk

The group holds equity investments, typically made for strategic purposes, that are classified as non-current available-for-sale financial assets and

are measured initially at fair value with changes in fair value recognized in other comprehensive income. Accumulated fair value changes are recycled

to the income statement on disposal, or when the investment is impaired. No impairment losses have been recognized in 2009 (2008 $546 million

and 2007 nil) relating to listed non-current available-for-sale investments. For further information see Note 25.

At 31 December 2009, it is estimated that an increase of 10% in quoted equity prices would result in an immediate credit to other

comprehensive income of $130 million (2008 $59 million credit to other comprehensive income), whilst a decrease of 10% in quoted equity prices

would result in an immediate charge to other comprehensive income of $130 million (2008 $48 million charge to profit or loss and $11 million charge

to other comprehensive income).

At 31 December 2009, 73% (2008 56%) of the carrying amount of non-current available-for-sale financial assets represented the group’s stake

in Rosneft, thus the group’s exposure is concentrated on changes in the share price of this equity in particular.

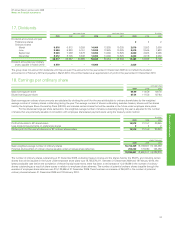

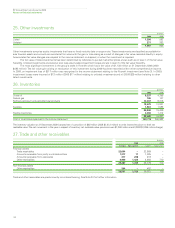

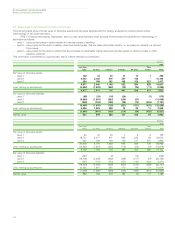

(b) Credit risk

Credit risk is the risk that a customer or counterparty to a financial instrument will fail to perform or fail to pay amounts due causing financial loss to the

group and arises from cash and cash equivalents, derivative financial instruments and deposits with financial institutions and principally from credit

exposures to customers relating to outstanding receivables.

The group has a credit policy, approved by the CFO, that is designed to ensure that consistent processes are in place throughout the

group to measure and control credit risk. Credit risk is considered as part of the risk-reward balance of doing business. On entering into any

business contract the extent to which the arrangement exposes the group to credit risk is considered. Key requirements of the policy are

formal delegated authorities to the sales and marketing teams to incur credit risk and to a specialized credit function to set counterparty

limits; the establishment of credit systems and processes to ensure that counterparties are rated and limits set; and systems to monitor

exposure against limits and report regularly on those exposures, and immediately on any excesses, and to track and report credit losses.

The treasury function provides a similar credit risk management activity with respect to group-wide exposures to banks and other

financial institutions.

In the current economic environment the group has placed increased emphasis on the management of credit risk. Policies and procedures

were reviewed in 2008 and credit exposures arising from physical commodity and derivative transactions with banks and other counterparties have

been reduced in 2008 and 2009, mainly through netting and collateral arrangements.

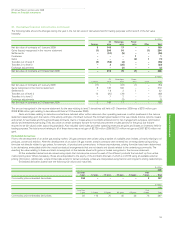

Before trading with a new counterparty can start, its creditworthiness is assessed and a credit rating is allocated that indicates the

probability of default, along with a credit exposure limit. The assessment process takes into account all available qualitative and quantitative

information about the counterparty and the group, if any, to which the counterparty belongs. The counterparty’s business activities, financial

resources and business risk management processes are taken into account in the assessment, to the extent that this information is publicly

available or otherwise disclosed to BP by the counterparty, together with external credit ratings, if any, including ratings prepared by Moody’s

Investor Service and Standard & Poor’s. Creditworthiness continues to be evaluated after transactions have been initiated and a watchlist of

higher-risk counterparties is maintained.

The group does not aim to remove credit risk but expects to experience a certain level of credit losses. The group attempts to mitigate

credit risk by entering into contracts that permit netting and allow for termination of the contract on the occurrence of certain events of

default. Depending on the creditworthiness of the counterparty, the group may require collateral or other credit enhancements such as cash

deposits or letters of credit and parent company guarantees. Trade receivables and payables, and derivative assets and liabilities, are

presented on a net basis where unconditional netting arrangements are in place with counterparties and where there is an intent to settle

amounts due on a net basis. The maximum credit exposure associated with financial assets is equal to the carrying amount. At 31 December

2009, the maximum credit exposure was $49,575 million (2008 $52,413 million). Collateral received and recognized in the balance sheet at

the year-end was $549 million (2008 $1,121 million) and collateral held off balance sheet was $48 million (2008 $203 million). Credit exposure

exists in relation to guarantees issued by group companies under which amounts outstanding at 31 December 2009 were $319 million (2008

$223 million) in respect of liabilities of jointly controlled entities and associates and $667 million (2008 $613 million) in respect of liabilities of

other third parties.

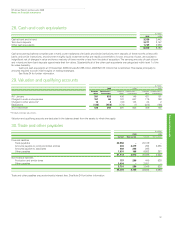

Notwithstanding the processes described above, significant unexpected credit losses can occasionally occur. Exposure to unexpected losses

increases with concentrations of credit risk that exist when a number of counterparties are involved in similar activities or operate in the same

industry sector or geographical area, which may result in their ability to meet contractual obligations being impacted by changes in economic,

political or other conditions. The group’s principal customers, suppliers and financial institutions with which it conducts business are located

throughout the world. In addition, these risks are managed by maintaining a group watchlist and aggregating multi-segment exposures to ensure

that a material credit risk is not missed.

Reports are regularly prepared and presented to the GFRC that cover the group’s overall credit exposure and expected loss trends, exposure by

segment, and overall quality of the portfolio. The reports also include details of the largest counterparties by exposure level and expected loss, and

details of counterparties on the group watchlist.

BP Annual Report and Accounts 2009

Notes on financial statements

Financial statements