BP 2009 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31. Derivative financial instruments continued

BP Annual Report and Accounts 2009

Notes on financial statements

Financial statements

153

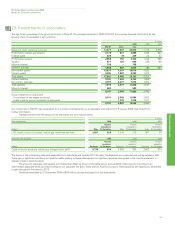

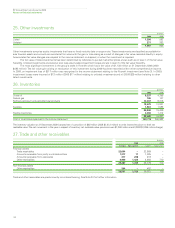

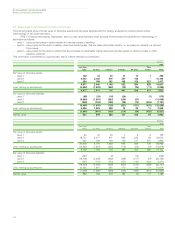

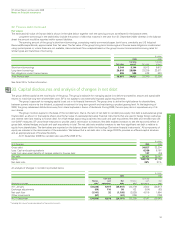

$ million

2008

Less than Over

1 year 1-2 years 2-3 years 3-4 years 4-5 years 5 years Total

Currency derivatives 53 90 67 37 20 11 278

Oil price derivatives 3,368 353 61 11 11 9 3,813

Natural gas price derivatives 3,940 1,090 545 436 271 663 6,945

Power price derivatives 688 256 31 1 2 – 978

Other derivatives 90 – – – – – 90

8,139 1,789 704 485 304 683 12,104

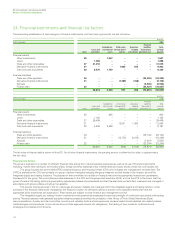

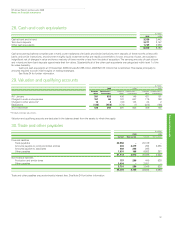

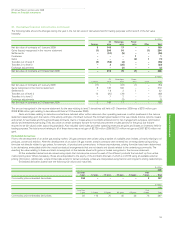

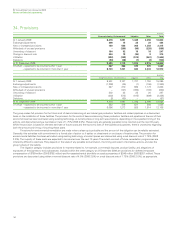

Derivative liabilities held for trading have the following fair values and maturities.

$ million

2009

Less than Over

1 year 1-2 years 2-3 years 3-4 years 4-5 years 5 years Total

Currency derivatives (110) (58) (20) (32) (4) (2) (226)

Oil price derivatives (1,083) (67) (29) (11) (1) – (1,191)

Natural gas price derivatives (2,381) (607) (248) (222) (78) (424) (3,960)

Power price derivatives (335) (109) (39) (11) (3) – (497)

Other derivatives (47) – – – – – (47)

(3,956) (841) (336) (276) (86) (426) (5,921)

$ million

2008

Less than Over

1 year 1-2 years 2-3 years 3-4 years 4-5 years 5 years Total

Currency derivatives (257) – (2) (1) (13) – (273)

Oil price derivatives (3,001) (458) (36) (18) (9) (1) (3,523)

Natural gas price derivatives (3,484) (987) (438) (310) (283) (611) (6,113)

Power price derivatives (722) (159) (18) (4) (1) – (904)

Other derivatives (95) (1) – – – – (96)

(7,559) (1,605) (494) (333) (306) (612) (10,909)

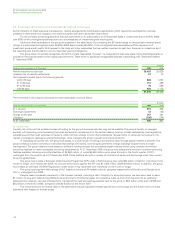

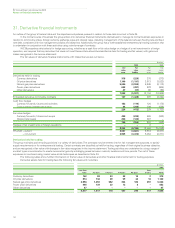

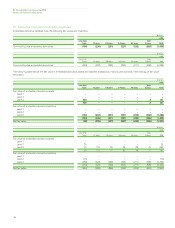

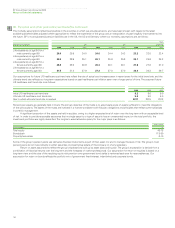

If at inception of a contract the valuation cannot be supported by observable market data, any gain or loss determined by the valuation methodology is not

recognized in the income statement but is deferred on the balance sheet and is commonly known as ‘day-one profit or loss’. This deferred gain or loss is

recognized in the income statement over the life of the contract until substantially all of the remaining contract term can be valued using observable market

data at which point any remaining deferred gain or loss is recognized in the income statement. Changes in valuation from this initial valuation are

recognized immediately through the income statement.

The following table shows the changes in the day-one profits and losses deferred on the balance sheet.

$ million

2009 2008

Natural Natural

Oil price gas price Oil price gas price

Fair value of contracts not recognized through the income statement at 1 January 32 83 – 36

Fair value of new contracts at inception not recognized in the income statement – (14) 66 49

Fair value recognized in the income statement (11) (36) (34) (2)

Fair value of contracts not recognized through the income statement at 31 December 21 33 32 83