BP 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

Board performance report

I am pleased to have this opportunity to report to you on the work of the

BP board over the last year.

I joined the board as a non-executive director in September 2009

and took the chair on 1 January 2010 upon the retirement of Peter

Sutherland. Peter has reviewed this letter and I, of course, have had the

benefit of the views of my board colleagues on its content.

This is a particularly interesting time for me to take the chair at BP.

In the past months we have seen the reports of Sir David Walker and the

Financial Reporting Council (FRC), to which we have contributed. The way

in which boards work has again been in the spotlight. There are a number

of lessons that all boards can learn from the events of 2008 and 2009.

Both these reports have focused on the need for appropriate behaviours

around the board table and for governance not to be regarded as solely

relating to compliance. This is a view which BP has taken for some time

and which I fully endorse.

I have been impressed by BP’s commitment to the highest

standards of corporate governance. Governance describes all that a board

does – a point which has been reinforced by the FRC’s draft revised

Combined Code. It is vital that a board balances the time that it spends

between strategy and oversight. From early indications, I believe that the

BP board achieves this balance well.

The board is responsible for the direction and oversight of

BP p.l.c. on behalf of shareholders; it is accountable to them,

as owners, for all aspects of BP’s business. It sets the tone from the top.

In conducting its business, BP needs to be responsive to other

constituencies with whom it comes into contact.

Governance framework

Clarity of roles and responsibilities, and the proper utilization of distinct

skills and processes lie at the heart of the board’s role. The BP board

governance principles (‘principles’) are the framework within which the

board operates.

This framework sets out the role of the board, its processes,

its relationship with executive management and the main tasks and

requirements of the board committees. The board’s core activities

include:

• The active consideration of long-term strategy.

• The monitoring of executive action and the performance of BP.

• Obtaining assurance that the material risks to BP are identified and

that systems of risk management and control are in place to mitigate

such risks.

• Ongoing board and executive management succession.

The principles can be seen on BP’s website at www.bp.com/governance.

The board delegates authority for executive management of the company

to the group chief executive. This delegation is subject to a clearly defined

set of executive limitations which are monitored by the board. The

executive limitations require the group chief executive to take into

consideration specific issues in the course of business – these include

key risk areas such as health, safety and environmental matters and

generally ensuring that BP’s reputation is maintained. The group chief

executive is also responsible for ensuring there is a comprehensive

system of controls to identify and manage the risks that are material

to BP.

The board keeps this framework under regular review and tests

its effectiveness through the annual board evaluation.

BP Annual Report and Accounts 2009

Board performance and biographies

Board performance and biographies

Board activities in 2009

The board’s work reflects the tasks described above, namely strategy,

risk and the oversight of the company’s performance and operation of

the system of delegation.

The board endeavours to balance its work so that these tasks are

achieved either through the work of the board or its committees. At the

start of each year, the board reviews and agrees a forward workplan

based upon:

• The need for the board to be involved in strategy development and

the oversight of risk.

• Annual reviews of the two business segments and of the corporate

business and functions which includes Alternative Energy.

• Oversight of risk generally and specifically those risks identified

through the annual plan (the board will decide which risk issues will

be considered by the whole board and which will be delegated to the

committees with appropriate reporting to the board).

• Consideration of quarterly and annual corporate reporting

documentation.

In determining its programme the board has to allow sufficient time for

urgent issues to be accommodated. The board will meet by telephone

should circumstances dictate.

The board now holds one of its meetings at the company’s

offices in Washington and will meet at other locations when appropriate.

In 2009, the board met in Long Beach, California and used this

opportunity to visit the company’s businesses in the West Coast fuels

value chain and to learn about the research taking place into biofuels.

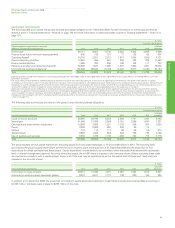

An analysis of the time spent by the board during 2009 is shown below:

Board activities

Approximate allocation of agenda time in 2009*

20%

20%

41%

11%

4%

4%

GCE and executive director updates,

business reviews (including safety)

Strategy and risk

Country specific reports (including safety)

Functional reviews

Financial and corporate reporting

Other matters *Excludes time spent on site visits.

Strategy and risk

While strategic issues are normally discussed at the two dedicated away

day sessions, the development of the group’s business over the year has

meant that strategic issues have been actively considered at a number of

meetings. Strategic and geopolitical challenges, together with the

associated risks are at the core of the group’s business.

The business and competitive environment, the global economic

outlook, the impact of the price of oil, the issues raised by carbon policy,

the technological challenges and strengths of the group were all matters

which the board kept under review.