BP 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

BP Annual Report and Accounts 2009

Business review

Group chief

executive’s review

Tony Hayward Group Chief Executive

26 February 2010

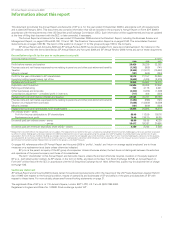

Highlights

• Progress on safe and reliable operations.

• Real momentum in growing our businesses.

• Continued focus on effi ciency and improvement.

Effi ciency,

momentum

and growth

2009 saw the continuation of diffi cult

economic conditions and a volatile energy

market, with rising demand for oil in

non-OECD countries failing to offset lower

levels of consumption in OECD countries.

Oil prices began the year at $36.55 per

barrel and recovered to $77.67 per barrel

in December. Refi ning margins and gas

prices fell sharply. Despite these diffi cult

conditions, a revitalized BP kept up its

momentum and delivered strong operating

and fi nancial results while continuing to

focus on safe and reliable operations.

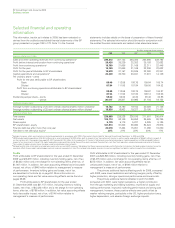

Replacement cost profi t for the year was

$14 billion, with a return on average capital

employeda of 11%.

a The return on average capital employed on a replacement

basis is the ratio of replacement cost profi t before interest

expense and minority interest but after tax, to the average

of opening and closing capital employed. Capital employed

is BP shareholders’ interest, plus fi nance debt and minority

interest.

Performance has been restored and

the group is competitive with the

industry once again, so what

priorities have you now set for BP?

Our priorities have remained absolutely

consistent – safety, people and performance

– and you can see the results of this focus

with improvements on all three fronts.

This year we have increased emphasis on

operational effi ciency, with a particular focus

on compliance and continuous improvement.

Achieving safe, reliable and compliant

operations is our number one priority and

the foundation stone for good business.

This year we achieved a reported recordable

injury frequency of 0.34, an improvement of

20% over 2008. In Refi ning and Marketing

reported major incidents have been reduced

by 90% since 2005. All our operated

refi neries and petrochemicals plants now

operate on the BP operating management

system (OMS), which governs how BP’s

operations, sites, projects and facilities are

managed. In Exploration and Production 47

of our 54 sites completed the transition to

OMS by the end of 2009, and I expect all BP

operations to be on OMS by the end of 2010.

This represents good progress and we must

remain absolutely vigilant.

Why are you putting such strong

emphasis on operational effi ciency?

In 2009 we invested $20 billion in our

businesses and realized more than $4 billion

in cash costb savings, of which approximately

40% related to foreign exchange benefi ts

and lower fuel costs. Within an organization

of our scale, putting a long-term commitment

to effi ciency at the heart of the group is

essential to improving earnings, year after

year. Our challenge is to maintain a relentless

focus on continuous improvement, making

today better than yesterday, so that we

continue to drive the business forward

whatever the market conditions.

What does the focus on effi ciency

and continuous improvement mean

for your people?

Better performance starts and ends with the

actions of individuals and I want to thank our

employees for the commitment they showed

in 2009. Our performance speaks volumes

b

Cash costs are a subset of production and manufacturing

expenses plus distribution and administration expenses.

They represent the substantial majority of the expenses in

these line items but exclude associated non-operating items

and certain costs that are variable, primarily with volumes

(such as freight costs). They are the principal operating and

overhead costs that management considers to be most

directly under their control although they include certain

foreign exchange and commodity price effects.

about their motivation and skills. The results

from our 2009 employee survey confi rm

that employee morale is improving as our

operational performance improves.

We have placed greater emphasis on

organizational quality, which is about driving

continuous improvement in our leadership

and culture, skills and capability, and systems

and processes. We have redesigned the way

we manage and reward people to incentivize

performance. We are simplifying the

organization and freeing people to do their

jobs. We are placing particular value on deep

specialist skills and technical expertise, and

are developing and recruiting the excellent

professionals we need to ensure a

sustainable future for the group.

How is this focus translating into

performance in Exploration and

Production?

2009 was an outstanding year. Reported

production grew by 4% and unit production

costs were down by 12%. We are now the

largest producer in deepwater fi elds globally.

In the Gulf of Mexico we ramped up

production at Thunder Horse to more than

300,000 barrels of oil equivalent per day.

Production started from Atlantis Phase 2,

Dorado and King South. And in September

we announced the Tiber discovery, the

deepest oil and gas discovery well ever

drilled. These successes make us the largest

producer and leading resource holder in the

deepwater Gulf of Mexico.

During the year we also shipped

the fi rst cargo of liquefi ed natural gas (LNG)

from the Tangguh project in Indonesia, and

we brought fi rst gas onstream at Savonette,

Trinidad & Tobago, in record time. We also

gained access to new resource opportunities

in Iraq, Egypt, the Gulf of Mexico, Indonesia,

Jordan and onshore US. We entered Iraq

through a contract to expand production

from the Rumaila fi eld near Basra, one of the

largest oil fi elds in the world. Working with

partners China National Petroleum Company

(CNPC) and the Iraqi State Oil Marketing

Organization (SOMO), we intend to grow

production in Rumaila from approximately

1 million barrels per day to 2.85 million

barrels per day.

Overall, 2009 was the 17th

consecutive year of delivering reported

reserves replacement of more than

100%. Our success in adding reserves

and resources gives us confi dence in our

ability to grow oil and gas production.