BP 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

BP Annual Report and Accounts 2009

Business review

Business review

Business review – Group overview

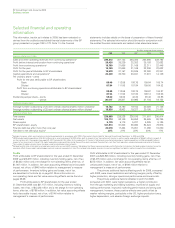

Global energy demand by type

(million tonnes of oil equivalent)

Other renewables 20

Biomass and waste

Coal

Hydroelectricity

Nuclear energy 16

Natural gas

Oil

12

8

4

1990 2007 2015 2030

Source: World Energy Outlook 2009. ©

OECD/IEA 2009, page 622: ‘Reference

Scenario, World’.

Long-term outlook

Recent economic conditions have weakened global demand for primary

energy, but a number of forecasts predict a return to growth in the

medium term. This is underpinned by continuing population growth and

by generally rising living standards in the developing world, including the

expansion of urban populations.

Under the International Energy Agency’s (IEA) reference scenario,

global energy demand is projected to increase by around 40% between

2007 and 2030a. That scenario also projects that fossil fuels will still be

satisfying as much as 80% of the world’s energy needs in 2030. At

current rates of consumption, the world has enough proved reserves of

fossil fuels to meet these requirementsbif investment is permitted to

turn those reserves into production capacity. However, to meet the

potential growth in demand, continued investment in new technology will

be required in order to boost recovery from declining fields and

commercialize currently inaccessible resources. For example, in oil alone,

where we believe there are reserves in place to satisfy approximately

40 years’ demand at current rates of consumptionb, we estimate that our

industry will need to bring nearly 50 million barrels per day of new

capacity onstream by 2030 if it is to meet the increased demand. To play

their part in achieving this, energy companies such as BP will need

secure and reliable access to as-yet undeveloped resources. We estimate

that more than 80% of the world’s oil resources are held by Russia,

Mexico and members of OPEC – areas where international oil companies

are frequently limited or prohibited from applying their technology and

expertise to produce additional supply. New partnerships will be required

to transform latent resources into much-needed proved reserves.

A more diverse mix of energy will also be required to meet this

increased demand. Such a mix is likely to include both unconventional

fossil fuel resources – such as oil sands, coalbed methane and natural

gas produced from shale formations – and renewable energy sources

such as wind, biofuels and solar power. Beyond simply meeting growth

in overall demand, a diverse mix would also help to provide enhanced

national and global energy security while supporting the transition to a

lower-carbon economy. Improving the efficiency of energy use will also

play a key role in maintaining energy market balance in the future.

Along with increasing supply, we believe the energy industry will be

required to make hydrocarbons cleaner and more efficient to use –

particularly in the critical area of power generation, for which the key

hydrocarbons are currently coal and gas. The world has reserves of coal

for around 120 years at current consumption ratesb, but coal produces

more carbon than any other fossil fuel. Carbon capture and storage (CCS)

may help to provide a path to cleaner coal, and BP is investing in this

area, but CCS technologies still face significant technical and economic

issues and are unlikely to be in operation at scale for at least a decade.

In contrast, we believe that in many countries natural gas has the

potential to provide the most significant reductions in carbon emissions

from power generation in the shortest time and at the lowest cost. These

reductions can be achieved using technology available today. Combined-

cycle turbines, fuelled by natural gas, produce around half the CO2

emissions of coal-fired power, and are cheaper and quicker to build. It is

estimated that there are reserves of natural gas in place equivalent to

60 years’ consumption at current ratesband they are rising as new skills

and technology unlock new unconventional gas resources. For these

reasons, gas is looking to be an increasingly attractive resource in

meeting the growing demand for energy, playing a greater role as a key

part of the energy future.

At the same time, alternative energies also have the potential to

make a substantial contribution to the transition to a lower-carbon

economy, but this will require investment, innovation and time. Currently,

wind, solar, wave, tide and geothermal energy account for only around

1% of total global consumptionc. Even in the most aggressive scenario

put forward by the IEA, these forms of energy are estimated to meet no

more than 5% of total demand in 2030d.

If industry and the market are to meet the world’s growing

demand for energy in a sustainable way, governments will be required to

set a stable and enduring framework. As part of this, governments will

need to provide secure access for exploration and development of fossil

fuel resources, define mutual benefits for resource owners and

development partners, and establish and maintain an appropriate legal

and regulatory environment, including a mechanism for recognizing and

incorporating the cost of reducing carbon emissions.

aWorld Energy Outlook 2009. ©OECD/IEA 2009, pages 622-623: ‘Reference Scenario, World’. The

IEA’s reference scenario describes what would happen if, among other things, governments were

to take no new initiatives bearing on the energy sector, beyond those already adopted by mid-2009.

bBP Statistical Review of World Energy June 2009. This estimate is not based on proved reserves as

defined by SEC rules.

cAdapted from World Energy Outlook 2009. ©OECD/IEA 2009, page 74. The IEA’s 450 policy

scenario assumes governments adopt commitments to limit the long-term concentration of

greenhouse gases in the atmosphere to 450 parts per million of CO2equivalent.

dWorld Energy Outlook 2009. ©OECD/IEA 2009, page 212: ‘World primary energy demand by fuel in

the 450 Scenario (Mtoe)’.