BP 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

BP Annual Report and Accounts 2009

Directors’ remuneration report

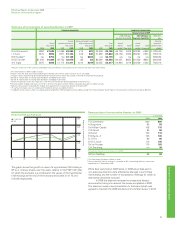

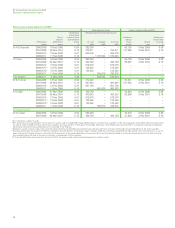

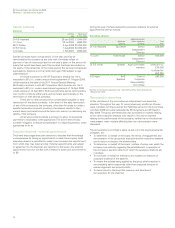

Performance conditions

Performance conditions for the 2010-12 share element will continue the

structure used in the 2009-2011 plan.

Vesting of shares will be based, as to one-third, on BP’s TSR

compared with other oil majors over a three-year period and as to

two-thirds, on a balanced scorecard of underlying performance. BP’s

TSR performance will be compared with the other oil majors –

ExxonMobil, Shell, Total, ConocoPhillips and Chevron. This comparison

group can be altered if circumstances change, for example, if there is

significant consolidation or change in the industry. While this comparison

group is narrow, it is used by both management and shareholders in

assessing BP’s comparative TSR performance.

The inclusion of relative TSR is an appropriate way of measuring

performance for the purposes of a long-term incentive for executive

directors as it reflects the creation of shareholder value while minimizing

the impact of sector specific events such as the oil price. TSR is

calculated as share price performance over the relevant period, assuming

dividends are reinvested. All share prices are averaged over the three-

month period before the beginning and end of the performance period.

They are measured in US dollars.

The balanced scorecard will be assessed by the committee on

three measures reflecting key priorities in BP’s strategy, production

growth, Refining and Marketing profitability and group underlying net

income. Both production growth and Refining and Marketing profitability

are key strategic objectives for the group and key drivers of value for

shareholders. Group underlying net income acts as a holistic measure of

success reflecting revenues, costs and complexity as well as safe and

reliable operations. The three underlying measures will be averaged to

form the balanced scorecard component.

All the above measures will be compared with the other oil

majors to determine the overall vesting result. The methodology used

will rank each of the five other majors on each of the measures. BP’s

performance will then be compared on an interpolated basis relative to

the performance of the other five. Performance shares will vest at 100%,

70% and 35% for performance equivalent to first, second and third rank

respectively and none for fourth or fifth place. For performance between

second and third or first and second, the result will be interpolated based

on BP’s performance relative to the company ranked directly above and

below it.

The committee considers that this combination of measures

provides a good balance of external as well as internal metrics reflecting

both shareholder value and operating priorities. As in previous years, the

committee may exercise its discretion, in a reasonable and informed

manner, to adjust vesting levels upwards or downwards if it concludes

the quantitative approach does not reflect the true underlying health and

performance of BP’s business relative to its peers. It will explain any

adjustments in the next directors’ remuneration report following the

vesting, in line with its commitment to transparency.

In exceptional recruitment circumstances, the committee may

award performance shares that are subject to a requirement of continued

service over a specified period, rather than a corporate performance

condition.

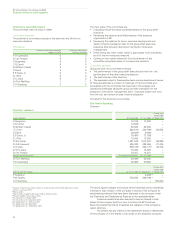

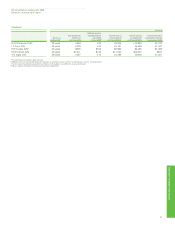

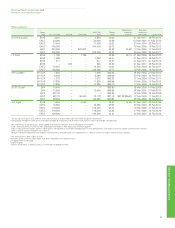

Pensions

Executive directors are eligible to participate in the appropriate pension

schemes applying in their home countries. Details are set out in the table

on page 87.

UK directors

UK directors are members of the regular BP Pension Scheme. The core

benefits under this scheme are non-contributory. They include a pension

accrual of 1/60th of basic salary for each year of service, up to a

maximum of two-thirds of final basic salary and a dependant’s benefit of

two-thirds of the member’s pension. The scheme pension is not

integrated with state pension benefits.

The rules of the BP Pension Scheme were amended in 2006 such

that the normal retirement age is 65. Prior to 1 December 2006, scheme

members could retire on or after age 60 without reduction. Special early

retirement terms apply to pre-1 December 2006 service for members

with long service as at 1 December 2006.

Pension benefits in excess of the individual lifetime allowance set

by legislation are paid via an unapproved, unfunded pension arrangement

provided directly by the company.

Although Mr Inglis is, like other UK directors, a member of the BP

Pension Scheme, he is currently based in Houston, US. His participation

in the BP Pension Scheme gives rise to a US tax liability. During 2009, the

committee approved the discharge of this US tax liability under a tax

equalization arrangement amounting to $90,314.

US directors

Dr Grote and Mr Dudley participate in the US BP Retirement

Accumulation Plan (US plan) which features a cash balance formula.

Pension benefits are provided through a combination of tax-qualified and

non-qualified benefit restoration plans, consistent with US tax regulations

as applicable.

The Supplemental Executive Retirement Benefit (supplemental

plan) is a non-qualified top-up arrangement that became effective on

1 January 2002 for US employees above a specified salary level. The

benefit formula is 1.3% of final average earnings, which comprise base

salary and bonus in accordance with standard US practice (and as

specified under the qualified arrangement), multiplied by years of service.

There is an offset for benefits payable under all other BP qualified and

non-qualified pension arrangements. This benefit is unfunded and

therefore paid from corporate assets.

Dr Grote and Mr Dudley are eligible to participate under

the supplemental plan. Their pension accrual for 2009, shown in the

table below, includes the total amount that could become payable

under all plans.

Other benefits

Executive directors are eligible to participate in regular employee

benefit plans and in all-employee share saving schemes applying in

their home countries. Benefits in kind are not pensionable. BP provides

accommodation in London for both Mr Inglis and Mr Dudley.