BP 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial reporting

During the year, the committee reviewed the group’s quarterly financial

reports, the annual report and accounts, the annual review and the 20-F

before recommending their publication to the board. The committee also

discussed with management the critical accounting policies and

judgements applied in the preparation of those financial reports. This

included key assumptions regarding significant provisions, including

those for decommissioning and environmental remediation and those

used for impairment testing. (See Financial statements – Note 3 on page

124.)

Monitoring business risk

The committee reviewed reports on the inherent risks within selected

areas of BP’s businesses and supporting functions. This together with

the related controls and assurance processes is designed to manage and

mitigate such risks. On top of reviewing the major business areas and

functions within BP, this year specific focus was additionally given to

Treasury activities, including debt and liquidity management, to

information technology and to the group’s oil and gas trading activities.

The committee also reviewed risk management and investment strategy

related to pensions and other post-retirement benefits, the management

of taxation and litigation exposures and the management of BP’s

approach to insurance.

The work and scope of the executive-level Group Financial Risk

Committee (which provides assurance to the executive on the

management of BP’s financial risk) was reported to the committee

during the year by the chief financial officer.

Internal control and audit

The committee holds an annual joint meeting at the start of each year

with the safety, ethics and environment assurance committee to review

the general auditor’s report on internal controls and risk management for

the previous year. This provides important input into the board’s review of

the company’s system of internal control.

The committee’s agenda includes standing items addressing

internal control and these included in 2009 the quarterly internal audit

findings report and the annual assessment of BP’s enterprise level

controls.

Further detail on risk management and internal control in BP is

outlined in the governance section of this board performance report

above.

External auditors

The committee held two private meetings during the year with the

external auditors. These provided additional opportunity for open dialogue

and feedback from both the committee and the auditors without the

presence of BP management. At these meetings, topics covered

included the quality of interaction with executive management, the

strength of the financial team and the effectiveness of the internal audit

function. I also meet on my own with the external auditors prior to each

audit committee to discuss the forthcoming agenda.

The committee undertakes regular reviews of the performance,

effectiveness and viability of the external auditors. As part of its 2009

review, senior partners at Ernst & Young who were independent of the

audit team responsible for BP undertook an evaluation process, which

involved 22 face-to-face interviews with those BP board members and

senior management who have key interactions with the external auditors.

In addition, there was a web-based survey of 185 people representing a

cross section of BP’s global finance organization, covering both group

reporting and statutory locations. The results of the interviews and

surveys were presented to the committee by the independent senior

partners in July and the auditors were asked to develop an action plan to

address a small number of areas identified for improvement.

76

BP Annual Report and Accounts 2009

Board performance and biographies

The external auditor followed up these findings with a report to the

committee in November which outlined its responses to these areas.

The external auditors will perform an assessment of service quality in

2010 to review the progress against the development areas outlined in

the feedback.

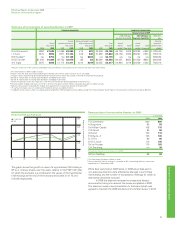

Fees paid to the external auditor for the year (see Financial

statements – Note 14 on page 136) were $54 million, of which 15% was

for non-audit work. The fees and services provided by Ernst & Young for

both audit and non-audit work have decreased in comparison to previous

years reflecting a joint approach to raising efficiency in audit processes as

well as a reduction in tax services and services related to corporate

finance transactions. All non-audit work is subject to the committee’s

advance approval policy and is monitored on a quarterly basis.

The audit committee has considered the proposed fee structure

and audit engagement terms for 2010 and has recommended to the

board that the reappointment of the external auditors be proposed to

shareholders at the 2010 AGM.

Internal audit

The general auditor attends all committee meetings but also meets

regularly on a one-to-one basis with myself as committee chairman.

In July the general auditor met privately with the committee without the

presence of executive management or the external auditors. In reviewing

the effectiveness and quality of the internal audit, the committee also

sought input from external auditors.

The committee receives a quarterly update on the progress of

internal audit against its schedule of audits, is notified of their key

findings and tracks any material actions that are overdue or have been

rescheduled. The proposed internal audit work programme for the year

was agreed by the committee in January. The committee was satisfied

that it appropriately responded to the key risks facing the company and

that the function had sufficient staff and resources to complete its work.

Other activities

The committee receives quarterly reports from the group compliance and

ethics function which examine areas of potential non-compliance with

the company’s Code of Conduct and remedial actions that are being

undertaken. The committee also receives an annual certification report

which is signed by the group chief executive. The committee reviews

quarterly reports on financial issues and concerns that have been

raised through the group-wide employee concerns programme, OpenTalk

and quarterly updates from internal audit on instances of actual or

potential fraud.

Committee evaluation

The committee conducts an annual review of its performance and

effectiveness. For 2009, this review was facilitated externally as part of

the wider review of the board and its committees. The external facilitator

undertook one-to-one interviews with each committee member, plus

those who provide support to the committee and the external auditor.

The review concluded that the audit committee was effective in carrying

out its duties.

On behalf of the audit committee,

Sir Ian Prosser

Audit committee chairman