BP 2009 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2009

Notes on financial statements

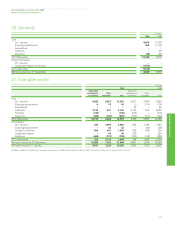

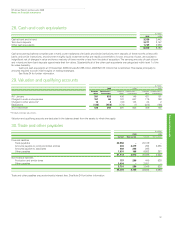

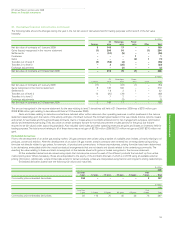

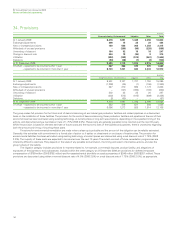

25. Other investments

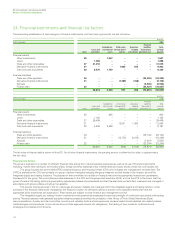

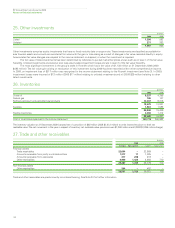

$ million

2009 2008

Listed 1,296 592

Unlisted 271 263

1,567 855

Other investments comprise equity investments that have no fixed maturity date or coupon rate. These investments are classified as available-for-

sale financial assets and as such are recorded at fair value with the gain or loss arising as a result of changes in fair value recorded directly in equity.

Accumulated fair value changes are recycled to the income statement on disposal, or when the investment is impaired.

The fair value of listed investments has been determined by reference to quoted market bid prices and as such are in level 1 of the fair value

hierarchy. Unlisted investments are stated at cost less accumulated impairment losses and are in level 3 of the fair value hierarchy.

The most significant investment is the group’s stake in Rosneft which had a fair value of $1,138 million at 31 December 2009 (2008

$483 million). The fair value gain arising on revaluation of this investment during 2009 has been recorded within other comprehensive income.

In 2008, an impairment loss of $517 million was recognized in the income statement relating to the Rosneft investment (see Note 3). In 2009,

impairment losses were incurred of $13 million (2008 $17 million) relating to unlisted investments and nil (2008 $29 million) relating to other

listed investments.

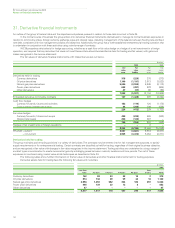

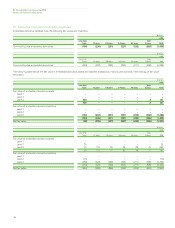

26. Inventories

150

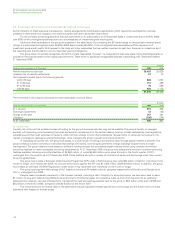

$ million

2009 2008

Crude oil 6,237 4,396

Natural gas 105 107

Refined petroleum and petrochemical products 12,337 9,318

18,679 13,821

Supplies 1,661 1,588

20,340 15,409

Trading inventories 2,265 1,412

22,605 16,821

Cost of inventories expensed in the income statement 163,772 266,982

The inventory valuation at 31 December 2009 is stated net of a provision of $46 million (2008 $1,412 million) to write inventories down to their net

realizable value. The net movement in the year in respect of inventory net realizable value provisions was $1,366 million credit (2008 $1,295 million charge).

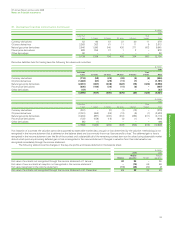

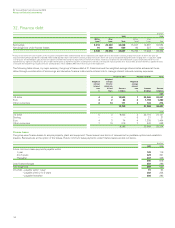

27. Trade and other receivables

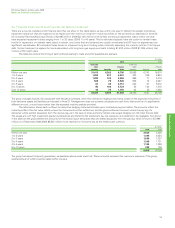

$ million

2009 2008

Current Non-current Current Non-current

Financial assets

Trade receivables 22,604 – 22,869 –

Amounts receivable from jointly controlled entities 1,317 11 1,035 –

Amounts receivable from associates 417 298 219 –

Other receivables 4,949 1,420 4,656 710

29,287 1,729 28,779 710

Non-financial assets

Other receivables 244 – 482 –

29,531 1,729 29,261 710

Trade and other receivables are predominantly non-interest bearing. See Note 24 for further information.