BP 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

BP Annual Report and Accounts 2009

Business review

Maritime security issues

At a strategic level, BP avoids known areas of pirate attack or armed

robbery; where this is not possible for trading reasons and we consider it

safe to do so, we will continue to trade vessels through these areas,

subject to the adoption of heightened security measures.

2009 has seen continuing pirate activity in the Gulf of Aden,

extending into the Indian Ocean (from the east coast of Somalia to

beyond the Seychelles) and a significant increase in the number of

international shipping incidents. The number of vessels actually

hijacked has remained roughly the same as 2008, as a result of

heightened awareness to the threat, and protective measures adopted by

transiting ships.

At present, we follow available military and government agency

advice and are participating in protective group transits through the Gulf

of Aden Maritime Security Patrol Area transit corridor. BP supports the

protective measures recommended in the international shipping industry

guide Best Management Practices to Deter Piracy in the Gulf of Adena.

Aluminium

Our aluminium business is a non-integrated producer and marketer of

rolled aluminium products, headquartered in Louisville, Kentucky, US.

Production facilities are located in Logan County, Kentucky, and are jointly

owned with Novelis. The primary activity of our aluminium business is the

supply of aluminium coil to the beverage can business, which it

manufactures primarily from recycled aluminium.

Treasury

Treasury manages the financing of the group centrally, ensuring liquidity

sufficient to meet group requirements and manages key financial risks

including interest rate, foreign exchange, pension and financial institution

credit risk. From locations in the UK, the US and the Asia Pacific region,

Treasury provides the interface between BP and the international

financial markets and supports the financing of BP’s projects around the

world. Treasury trades foreign exchange and interest rate products in the

financial markets, hedging group exposures and generating incremental

value through optimizing and managing flows. Trading activities are

underpinned by the compliance, control, and risk management

infrastructure common to all BP trading activities.

Insurance

The group generally restricts its purchase of insurance to situations

where this is required for legal or contractual reasons. This is because

external insurance is not considered an economic means of financing

losses for the group. Losses are therefore borne as they arise, rather

than being spread over time through insurance premiums with attendant

transaction costs. This position is reviewed periodically.

aJointly published and supported by Industry bodies, including OCIMF.

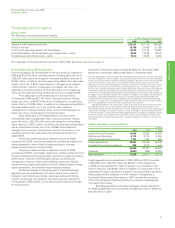

Research and technology

Research and technology (R&T) has a critical role to play in addressing the

world’s energy challenges, from fundamental research through to wide-

scale deployment. BP’s model is one of selective technology leadership,

where we have chosen 20 major technology programmes – 10 in

Exploration and Production, seven in Refining and Marketing and three

focused on lower-carbon value chains.

Inside the business segments, the full breadth of these activities

is carried out in service of competitive business performance and new

business development, through research and development (R&D) or

acquisition of new technologies. The central R&T group provides

leadership and assurance for scientific and technological activities across

BP with a focus on having the right capability in critical areas, overseeing

the quality of BP’s major technology programmes, and illuminating the

potential of emerging science. External assurance is achieved through

the Technology Advisory Council, which advises the board and executive

management on the state of research and technology within BP. The

Council comprises typically eight to 10 world-leading and eminent

industrialists and academics.

R&D is carried out using a balance of internal and external

resources. Involving third parties in the various steps of technology

development and application enables a wider range of ideas and

technologies to be considered and implemented, improving the impact of

research and development activities and the leverage of our spend.

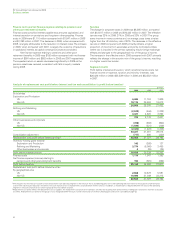

Across the group, expenditure on R&D for 2009 was $587 million,

compared with $595 million in 2008 and $566 million in 2007. See

Financial statements – Note 11 on page 134. Despite the economic

downturn of 2009, R&D spending remained roughly flat. In addition we

increased our focus on value realization from the application of

technology (including field trials), and capability development, which are

not included in the headline R&D expenditure.

In our Exploration and Production segment, we selectively focus

on 10 ‘flagship’ technology programmes which have the greatest

business impact. We consider that each has the potential to add more

than one billion boe to reserves through their development and

deployment in our assets worldwide. These technologies continue to

contribute to exploration and production success in Alaska, Angola,

Azerbaijan, Egypt, North Africa, the North Sea, Trinidad and the

deepwater Gulf of Mexico. 2009 highlights from four of these flagships

include:

•Advanced seismic imaging – BP’s expertise leads the industry, with

cutting-edge ‘simultaneous sweeping’ techniques being successfully

applied in onshore seismic surveys in Libya and Oman. Offshore, BP

completed its largest ever 3D surveys in Libya’s deepwater, carried

out the most northerly 3D seismic programme ever conducted (in the

Canadian Beaufort Sea), and deployed a wide azimuth towed

streamer in Angola – an acquisition configuration developed by

BP to image areas of complex geology below salt. These imaging

techniques significantly reduce time and costs needed to acquire

seismic data over vast areas.

•Enhanced oil recovery (EOR) technologies are pushing recovery

factors to new limits. By increasing the overall recovery factor from

our fields by 1%, we believe we can add 2 billion boe to our reserves.

At the Endicott field in Alaska, BP completed a field trial of its LoSalTM

EOR technology, which uses injection water with a much lower than

usual salt content to flush out or displace extra oil from the reservoir.

Following the success of this trial, the technology is now being

actively considered for application in several new projects. BP has

now performed 38 Bright Water™ treatments in Alaska, Argentina

and Pakistan, which have delivered an increase of more than 9 million

barrels to our recoverable volumes at a development cost of less than

$6 per barrel.