BP 2009 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2009

Notes on financial statements

31. Derivative financial instruments continued

154

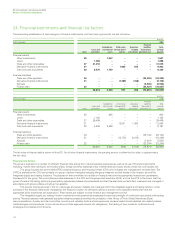

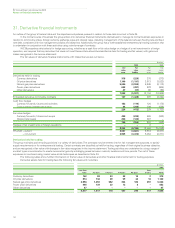

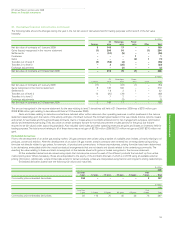

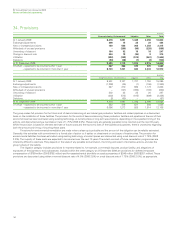

The following table shows the fair value of derivative assets and derivative liabilities held for trading, analysed by maturity period and by

methodology of fair value estimation.

IFRS 7 ‘Financial Instruments: Disclosures’ sets out a fair value hierarchy which consists of three levels that describe the methodology of

estimation as follows:

– Level 1 – using quoted prices in active markets for identical assets or liabilities.

– Level 2 – using inputs for the asset or liability, other than quoted prices, that are observable either directly (i.e. as prices) or indirectly (i.e. derived

from prices).

– Level 3 – using inputs for the asset or liability that are not based on observable market data such as prices based on internal models or other

valuation methods.

This information is presented on a gross basis, that is, before netting by counterparty.

$ million

2009

Less than Over

1 year 1-2 years 2-3 years 3-4 years 4-5 years 5 years Total

Fair value of derivative assets

Level 1 163 76 23 17 10 1 290

Level 2 9,544 2,182 915 357 146 – 13,144

Level 3 264 188 162 148 128 527 1,417

9,971 2,446 1,100 522 284 528 14,851

Less: netting by counterparty (5,494) (1,029) (384) (75) (35) (11) (7,028)

4,477 1,417 716 447 249 517 7,823

Fair value of derivative liabilities

Level 1 (95) (39) (14) (24) – (1) (173)

Level 2 (9,086) (1,681) (597) (234) (47) – (11,645)

Level 3 (269) (150) (109) (93) (74) (436) (1,131)

(9,450) (1,870) (720) (351) (121) (437) (12,949)

Less: netting by counterparty 5,494 1,029 384 75 35 11 7,028

(3,956) (841) (336) (276) (86) (426) (5,921)

Net fair value 521 576 380 171 163 91 1,902

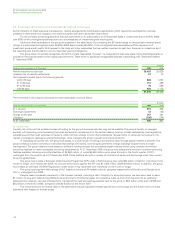

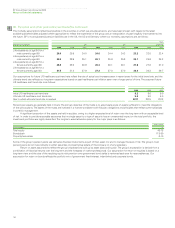

$ million

2008

Less than Over

1 year 1-2 years 2-3 years 3-4 years 4-5 years 5 years Total

Fair value of derivative assets

Level 1 40 43 30 7 6 2 128

Level 2 19,737 3,477 871 508 225 56 24,874

Level 3 687 196 148 140 137 672 1,980

20,464 3,716 1,049 655 368 730 26,982

Less: netting by counterparty (12,325) (1,927) (345) (170) (64) (47) (14,878)

8,139 1,789 704 485 304 683 12,104

Fair value of derivative liabilities

Level 1 (227) – (2) – (13) – (242)

Level 2 (19,106) (3,345) (683) (356) (217) (27) (23,734)

Level 3 (551) (187) (154) (147) (140) (632) (1,811)

(19,884) (3,532) (839) (503) (370) (659) (25,787)

Less: netting by counterparty 12,325 1,927 345 170 64 47 14,878

(7,559) (1,605) (494) (333) (306) (612) (10,909)

Net fair value 580 184 210 152 (2) 71 1,195