BP 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

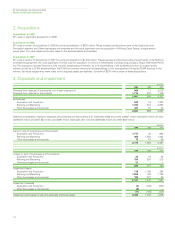

1. Significant accounting policies continued

Revenue

Revenue arising from the sale of goods is recognized when the

significant risks and rewards of ownership have passed to the buyer

and it can be reliably measured.

Revenue is measured at the fair value of the consideration

received or receivable and represents amounts receivable for goods

provided in the normal course of business, net of discounts, customs

duties and sales taxes.

Revenues associated with the sale of oil, natural gas, natural gas

liquids, liquefied natural gas, petroleum and chemicals products and all

other items are recognized when the title passes to the customer.

Physical exchanges are reported net, as are sales and purchases made

with a common counterparty, as part of an arrangement similar to a

physical exchange. Similarly, where the group acts as agent on behalf of

a third party to procure or market energy commodities, any associated

fee income is recognized but no purchase or sale is recorded.

Additionally, where forward sale and purchase contracts for oil, natural

gas or power have been determined to be for trading purposes, the

associated sales and purchases are reported net within sales and other

operating revenues whether or not physical delivery has occurred.

Generally, revenues from the production of oil and natural gas

properties in which the group has an interest with joint venture partners

are recognized on the basis of the group’s working interest in those

properties (the entitlement method). Differences between the production

sold and the group’s share of production are not significant.

Interest income is recognized as the interest accrues (using the

effective interest rate that is the rate that exactly discounts estimated

future cash receipts through the expected life of the financial instrument

to the net carrying amount of the financial asset).

Dividend income from investments is recognized when the

shareholders’ right to receive the payment is established.

Research

Research costs are expensed as incurred.

Finance costs

Finance costs directly attributable to the acquisition, construction or

production of qualifying assets, which are assets that necessarily take a

substantial period of time to get ready for their intended use, are added

to the cost of those assets, until such time as the assets are substantially

ready for their intended use. All other finance costs are recognized in the

income statement in the period in which they are incurred.

Use of estimates

The preparation of financial statements requires management to make

estimates and assumptions that affect the reported amounts of assets

and liabilities as well as the disclosure of contingent assets and liabilities

at the balance sheet date and the reported amounts of revenues and

expenses during the reporting period. Actual outcomes could differ from

those estimates.

Impact of new International Financial Reporting Standards

Adopted for 2009

The following new IFRS, and revised or amended IFRSs were adopted

by the group with effect from 1 January 2009, IFRS 8 ‘Operating

Segments’ was issued in November 2006 and defines operating

segments as components of an entity about which separate financial

information is available and is evaluated regularly by the chief operating

decision maker in deciding how to allocate resources and in assessing

performance. BP’s operating segments did not change as a result of

adopting the new standard and there was no effect on the group’s

reported income or net assets. The disclosures required by the standard

are included in this report, including the measures as used by the chief

operating decision maker.

In September 2007, the IASB issued a revised version of IAS 1

‘Presentation of Financial Statements’, which requires separate

presentation of owner and non-owner changes in equity by introducing

the statement of comprehensive income. The statement of recognized

income and expense is no longer presented. Whenever there is a

restatement or reclassification, an additional balance sheet, as at the

beginning of the earliest period presented, will be required to be

published. There was no effect on the group’s reported income or net

assets as a result of the adoption of this revised standard.

In March 2009, the IASB issued Amendments to IFRS 7

‘Financial Instruments: Disclosures – Improving Disclosures about

Financial Instruments’, which requires enhanced disclosures about fair

value measurements and liquidity risk. There was no effect on the

group’s reported income or net assets. The disclosures required by the

standard are included in this report.

In addition, several other standards and interpretations

were adopted in the year which had no significant impact on the

financial statements.

Not yet adopted

The following pronouncements from the IASB will become effective

for future financial reporting periods and have not yet been adopted by

the group.

In January 2008, the IASB issued a revised version of IFRS 3

‘Business Combinations’. The revised standard still requires the purchase

method of accounting to be applied to business combinations but will

introduce some changes to the existing accounting treatment. For

example, contingent consideration is measured at fair value at the date

of acquisition and subsequently remeasured to fair value with changes

recognized in profit or loss. Goodwill may be calculated based on the

parent’s share of net assets or it may include goodwill related to the

minority interest. All transaction costs are expensed. The standard is

applicable to business combinations occurring in accounting periods

beginning on or after 1 July 2009 and BP will adopt it with effect from

1 January 2010. Assets and liabilities arising from business combinations

that occurred before the date of adoption by the group will not be

restated and thus there will be no effect on the group’s reported income

or net assets on adoption. The revised standard has been adopted by

the EU.

Also in January 2008, the IASB issued an amended version of

IAS 27 ‘Consolidated and Separate Financial Statements’. This requires

the effects of all transactions with non-controlling interests to be

recorded in equity if there is no change in control. When control is lost,

any remaining interest in the entity is remeasured to fair value and a

gain or loss recognized in profit or loss. The amendment is effective for

annual periods beginning on or after 1 July 2009 and is to be applied

retrospectively, with certain exceptions. BP will adopt the amendment

with effect from 1 January 2010 and there will be no effect on the

group’s reported income or net assets on adoption. The revised standard

has been adopted by the EU.

In November 2009, the IASB issued IFRS 9 ‘Financial

Instruments’ which deals with the classification and measurement of

financial assets. This new standard represents the first phase of the

IASB’s project to replace IAS 39 ‘Financial Instruments: Recognition and

Measurement’. The new standard is effective for annual periods

beginning on or after 1 January 2013 with transitional arrangements

depending upon the date of initial application. BP has not yet decided the

date of initial application for the group and has not yet completed its

evaluation of the effect of adoption. The new standard has not yet been

adopted by the EU.

There are no other standards and interpretations in issue but not

yet adopted that the directors anticipate will have a material effect on the

reported income or net assets of the group.

123

Financial statements

BP Annual Report and Accounts 2009

Notes on financial statements