Albertsons 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

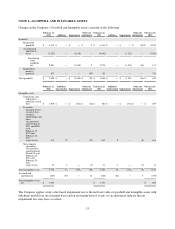

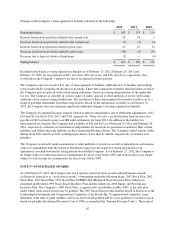

The difference between the actual tax provision and the tax provision computed by applying the statutory federal

income tax rate to earnings (losses) before income taxes is attributable to the following:

2012 2011 2010

Federal taxes based on statutory rate $ (360) $ (533) $ 221

State income taxes, net of federal benefit (1) (4) 20

Goodwill and intangible asset impairment 375 542 —

Other (2) (18) (2)

Total income tax provision (benefit) $ 12 $ (13) $ 239

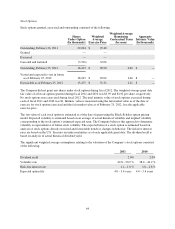

Deferred income taxes reflect the net tax effects of temporary differences between the bases of assets and

liabilities for financial reporting and income tax purposes. The Company’s deferred tax assets and liabilities

consisted of the following:

2012 2011

Deferred tax assets:

Compensation and benefits $ 531 $ 435

Self-insurance 217 241

Property, plant and equipment and capitalized lease assets 437 452

Net operating loss carryforward 39 38

Other 222 163

Gross deferred tax assets 1,446 1,329

Valuation allowance (25) (24)

Total deferred tax assets 1,421 1,305

Deferred tax liabilities:

Property, plant and equipment and capitalized lease assets (356) (345)

Inventories (253) (267)

Debt discount (75) (78)

Intangible assets (223) (342)

Other (31) (26)

Total deferred tax liabilities (938) (1,058)

Net deferred tax asset $ 483 $ 247

The Company has valuation allowances to reduce deferred tax assets to the amount that is more-likely-than-not

to be realized. The Company currently has state net operating loss (“NOL”) carryforwards of $816 for tax

purposes. The NOL carryforwards expire beginning in 2013 and continuing through 2030 and have a $25

valuation allowance.

61