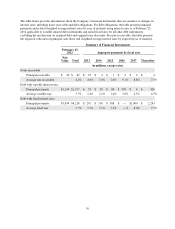

Albertsons 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.based on the Company’s industry, capital structure and risk premiums including those reflected in the current

market capitalization. If management identifies the potential for impairment of goodwill, the fair value of the

implied goodwill is calculated as the difference between the fair value of the reporting unit and the fair value of

the underlying assets and liabilities, excluding goodwill. An impairment charge is recorded for any excess of the

carrying value over the implied fair value. Fair value calculations contain significant judgments and estimates

related to each reporting unit’s projected weighted average cost of capital, future revenue, profitability, cash

flows and fair values of assets and liabilities. When preparing these estimates, management considers each

reporting unit’s historical results, current operating trends and specific plans in place. These estimates are

impacted by variable factors including inflation, the general health of the economy and market competition. The

Company has sufficient current and historical information available to support its judgments and estimates.

However, if actual results are not consistent with the Company’s estimates, future operating results may be

materially impacted.

The Company also reviews intangible assets with indefinite useful lives, which primarily consist of trademarks

and tradenames, for impairment during the fourth quarter of each year, and also if events or changes in

circumstances indicate that the asset might be impaired. The reviews consist of comparing estimated fair value to

the carrying value. Fair values of the Company’s trademarks and tradenames are determined primarily by

discounting an assumed royalty value applied to projected future revenues associated with the tradename based

on management’s expectations of the current and future operating environment. The royalty cash flows are

discounted using rates based on the weighted average cost of capital and the specific risk profile of the

tradenames relative to the Company’s other assets. These estimates are impacted by variable factors including

inflation, the general health of the economy and market competition.

During the third and fourth quarters of fiscal 2012 the Company’s stock price experienced a significant and

sustained decline. As a result, the Company performed reviews of goodwill and intangible assets with indefinite

useful lives for impairment, which indicated that the carrying value of traditional retail stores’ goodwill and

certain intangible assets with indefinite useful lives exceeded their estimated fair values. The Company recorded

preliminary non-cash impairment charges of $907, comprised of $661 of goodwill and $246 of intangible assets

with indefinite useful lives during the third quarter of fiscal 2012.

The finalization of third quarter impairment charges and the results of the fourth quarter impairment review

resulted in an additional non-cash impairment charge of $525 including an immaterial finalization to the third

quarter preliminary charge. The fourth quarter charge is comprised of $460 of goodwill and $65 of intangible

assets with indefinite useful lives and was recorded in the Retail food segment. The impairment charge was due

to the significant and sustained decline in the Company’s market capitalization as of and subsequent to the end of

the fourth quarter of fiscal 2012 and updated discounted future cash flows. All fiscal 2012 goodwill and

intangible asset impairment charges were recorded in the Retail food segment.

As a result of the third and fourth quarter reviews, total non-cash impairment charges of $1,432 were recorded,

comprised of $1,121 of goodwill and $311 of intangible assets with indefinite useful lives. The calculation of the

impairment charges contains significant judgments and estimates including weighted average cost of capital,

future revenue, profitability, cash flows and fair values of assets and liabilities.

Rates used in fiscal 2012 to discount projected future cash flows, which varied for each reporting unit, ranged

between 10 percent and 15 percent. Perpetual growth rates, which also varied for each reporting unit, ranged

between 1 percent and 3 percent. Management performed sensitivity analyses on the fair values resulting from

the discounted cash flow analysis utilizing alternate assumptions that reflect reasonably possible changes to

future assumptions. For the Independent business and Hard discount reporting units, a 100 basis point increase in

the discount rate utilized in the discounted cash flow analysis would not have resulted in either reporting unit

failing the first step of the impairment tests. For the independent business and hard discount reporting units, a

100 basis point decrease in the estimated perpetual sales growth rates utilized in the discounted cash flow

analysis would not have resulted in either reporting unit failing the first step of the impairment tests. The fair

value of Independent business’ goodwill exceeded its $710 carrying value by 50 percent and the fair value of the

30