Albertsons 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$126, pre-tax, or $78, after-tax, as of February 25, 2012, compared to February 26, 2011. The increase in the

amount of underfunding is attributable to the changes in contribution rates resulting from renegotiated collective

bargaining agreements and lower than anticipated return on assets. The estimate is based on the most current

information available to the Company including actuarial evaluations and other data, and may be outdated or

otherwise unreliable.

In fiscal 2012, the Company contributions to multiemployer plans decreased approximately 5 percent over the

prior year, primarily due to store closures and reductions in headcount. In fiscal 2011, the Company contributions

to multiemployer plans decreased approximately 17 percent over the prior year mainly due to store closures,

reductions in headcount and previously announced market exits. In fiscal 2013, the Company expects to

contribute approximately $142 to the multiemployer pension plans, subject to the outcome of collective

bargaining and capital market conditions. Furthermore, if the Company were to significantly reduce

contributions, exit certain markets or otherwise cease making contributions to these plans, it could trigger a

partial or complete withdrawal that would require the Company to record a withdrawal liability. Any withdrawal

liability would be recorded when it is probable that a liability exists and can be reasonably estimated, in

accordance with accounting standards.

The Company’s proportionate share of underfunding described above is an estimate and could change based on

the results of collective bargaining efforts, investment returns on the assets held in the plans, actions taken by

trustees who manage the plans’ benefit payments and requirements under the Pension Protection Act of 2006 and

Section 412(e) of the Internal Revenue Code.

The Company also makes contributions to multiemployer health and welfare plans in amounts set forth in the

related collective bargaining agreements. A small minority of collective bargaining agreements contain reserve

requirements that may trigger unanticipated contributions resulting in increased healthcare expenses. If these

healthcare provisions cannot be renegotiated in a manner that reduces the prospective healthcare cost as the

Company intends, the Company’s Selling and administrative expenses could increase in the future.

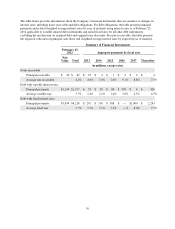

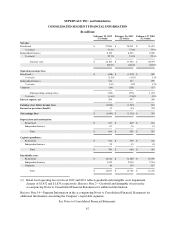

CONTRACTUAL OBLIGATIONS

The following table represents the Company’s significant contractual obligations as of February 25, 2012.

Payments Due Per Period

Total

Fiscal

2013

Fiscal

2014-

2015

Fiscal

2016-

2017 Thereafter

Contractual Obligations:

Long-term debt (1) $ 5,376 $ 324 $ 787 $1,596 $ 2,669

Interest on long-term debt (2) 3,531 356 671 517 1,987

Capital leases (3) 1,861 146 287 272 1,156

Operating leases (4) 2,654 310 606 485 1,253

Benefit obligations (5) 6,930 152 277 297 6,204

Construction commitments 117 115 2 — —

Deferred income taxes 478 (54) 56 56 420

Purchase obligations (6) 650 379 249 22 —

Self-insurance obligations 1,115 237 300 171 407

Total $22,712 $1,965 $3,235 $3,416 $ 14,096

37