Albertsons 2012 Annual Report Download - page 53

Download and view the complete annual report

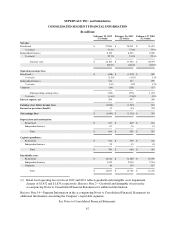

Please find page 53 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The retail inventory method approximates cost. The first-in, first-out method (“FIFO”) is primarily used to

determine cost for some of the remaining highly perishable inventories. If the FIFO method had been used to

determine cost of inventories for which the LIFO method is used, the Company’s inventories would have been

higher by approximately $342 and $282 as of February 25, 2012 and February 26, 2011, respectively.

During fiscal 2012, 2011 and 2010, inventory quantities in certain LIFO layers were reduced. These reductions

resulted in a liquidation of LIFO inventory quantities carried at lower costs prevailing in prior years as compared

with the cost of fiscal 2012, 2011 and 2010 purchases. As a result, Cost of sales decreased by $19, $11 and $22

in fiscal 2012, 2011 and 2010, respectively.

The Company evaluates inventory shortages throughout each fiscal year based on actual physical counts in its

facilities. Allowances for inventory shortages are recorded based on the results of these counts to provide for

estimated shortages as of the end of each fiscal year.

Reserves for Closed Properties

The Company maintains reserves for costs associated with closures of retail stores, distribution centers and other

properties that are no longer being utilized in current operations. The Company provides for closed property

lease liabilities based on the present value of the remaining noncancellable lease payments after the closing date,

reduced by estimated subtenant rentals that could be reasonably obtained for the property. The closed property

lease liabilities usually are paid over the remaining lease terms, which generally range from one to 20 years.

Adjustments to closed property reserves primarily relate to changes in subtenant income or actual exit costs

differing from original estimates. Adjustments are made for changes in estimates in the period in which the

changes become known.

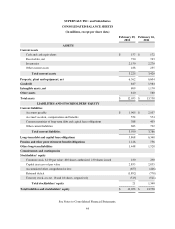

Property, Plant and Equipment

Property, plant and equipment are carried at cost. Depreciation is based on the estimated useful lives of the assets

using the straight-line method. Estimated useful lives generally are 10 to 40 years for buildings and major

improvements, three to 10 years for equipment, and the shorter of the term of the lease or expected life for

leasehold improvements and capitalized lease assets. Interest on property under construction of $6, $8 and $6

was capitalized in fiscal 2012, 2011 and 2010, respectively.

Goodwill and Intangible Assets

The Company reviews goodwill for impairment during the fourth quarter of each year, and also if events occur or

circumstances change that would more-likely-than-not reduce the fair value of a reporting unit below its carrying

amount. The reviews consist of comparing estimated fair value to the carrying value at the reporting unit level.

The Company’s reporting units are the operating segments of the business which consist of traditional retail

stores, hard-discount stores and independent business services. Fair values are determined by using both the

market approach, applying a multiple of earnings based on the guideline publicly traded company method, and

the income approach, discounting projected future cash flows based on management’s expectations of the current

and future operating environment. The rates used to discount projected future cash flows reflect a weighted

average cost of capital based on the Company’s industry, capital structure and risk premiums including those

reflected in the current market capitalization. If management identifies the potential for impairment of goodwill,

the fair value of the implied goodwill is calculated as the difference between the fair value of the reporting unit

and the fair value of the underlying assets and liabilities, excluding goodwill. An impairment charge is recorded

for any excess of the carrying value over the implied fair value.

The Company also reviews intangible assets with indefinite useful lives, which primarily consist of trademarks

and tradenames, for impairment during the fourth quarter of each year, and also if events or changes in

circumstances indicate that the asset might be impaired. The reviews consist of comparing estimated fair value to

the carrying value. Fair values of the Company’s trademarks and tradenames are determined primarily by

49