Albertsons 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

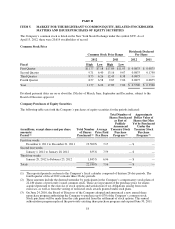

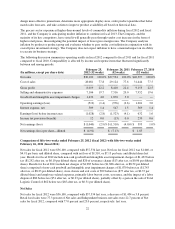

ITEM 6. SELECTED FINANCIAL DATA

(Dollars and shares in millions, except

percent and per share data)

2012

(52 weeks)

2011

(52 weeks)

2010

(52 weeks)

2009

(53 weeks)

2008

(52 weeks)

Operating Results

Net sales $ 36,100 $ 37,534 $ 40,597 $ 44,564 $ 44,048

Identical store retail sales increase

(decrease) (1) (2.8)% (6.0)% (5.1)% (1.2)% 0.5%

Cost of sales 28,081 29,124 31,444 34,451 33,943

Selling and administrative expenses 7,106 7,516 7,952 8,746 8,421

Goodwill and intangible asset

impairment charges (2) 1,432 1,870 — 3,524 —

Operating earnings (loss) (519) (976) 1,201 (2,157) 1,684

Interest expense, net 509 547 569 622 707

Earnings (loss) before income taxes (1,028) (1,523) 632 (2,779) 977

Income tax provision (benefit) 12 (13) 239 76 384

Net earnings (loss) (1,040) (1,510) 393 (2,855) 593

Net earnings (loss) as a percent of

net sales (2.88)% (4.02)% 0.97% (6.41)% 1.35%

Net earnings (loss) per share—

diluted (4.91) (7.13) 1.85 (13.51) 2.76

Financial Position

Inventories (FIFO) (3) $ 2,492 $ 2,552 $ 2,606 $ 2,967 $ 2,956

Working capital (3) (23) (84) (192) (109) (280)

Property, plant and equipment, net 6,362 6,604 7,026 7,528 7,533

Total assets 12,053 13,758 16,436 17,604 21,062

Debt and capital lease obligations 6,256 6,751 7,635 8,484 8,833

Stockholders’ equity 21 1,340 2,887 2,581 5,953

Other Statistics

Return on average stockholders’

equity (103.55)% (76.36)% 14.42% (59.32)% 10.44%

Book value per share $ 0.10 $ 6.32 $ 13.62 $ 12.19 $ 28.13

Current ratio (3) 0.99:1 0.98:1 0.95:1 0.98:1 0.94:1

Debt to capital ratio (4) 99.7% 83.4% 72.6% 76.7% 59.7%

Dividends declared per share $ 0.3500 $ 0.3500 $ 0.6100 $ 0.6875 $ 0.6750

Weighted average shares

outstanding—diluted 212 212 213 211 215

Depreciation and amortization $ 884 $ 925 $ 957 $ 1,057 $ 1,017

Capital expenditures (5) $ 700 $ 604 $ 691 $ 1,212 $ 1,227

Retail stores as of fiscal year end (6) 2,434 2,394 2,349 2,421 2,474

20