Albertsons 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116

|

|

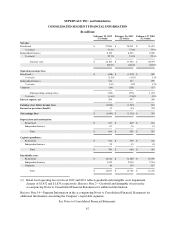

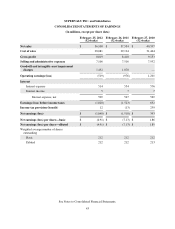

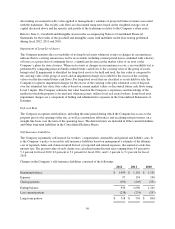

SUPERVALU INC. and Subsidiaries

CONSOLIDATED STATEMENTS OF EARNINGS

(In millions, except per share data)

February 25, 2012

(52 weeks)

February 26, 2011

(52 weeks)

February 27, 2010

(52 weeks)

Net sales $ 36,100 $ 37,534 $ 40,597

Cost of sales 28,081 29,124 31,444

Gross profit 8,019 8,410 9,153

Selling and administrative expenses 7,106 7,516 7,952

Goodwill and intangible asset impairment

charges 1,432 1,870 —

Operating earnings (loss) (519) (976) 1,201

Interest

Interest expense 514 554 576

Interest income 5 7 7

Interest expense, net 509 547 569

Earnings (loss) before income taxes (1,028) (1,523) 632

Income tax provision (benefit) 12 (13) 239

Net earnings (loss) $ (1,040) $ (1,510) $ 393

Net earnings (loss) per share—basic $ (4.91) $ (7.13) $ 1.86

Net earnings (loss) per share—diluted $ (4.91) $ (7.13) $ 1.85

Weighted average number of shares

outstanding

Basic 212 212 212

Diluted 212 212 213

See Notes to Consolidated Financial Statements.

43