Albertsons 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

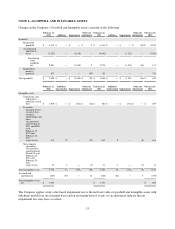

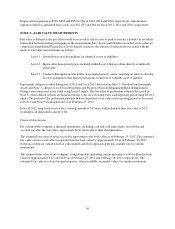

NOTE 6—LONG-TERM DEBT

The Company’s long-term debt and capital lease obligations consisted of the following:

2012 2011

1.65% to 4.75% Revolving Credit Facility and Variable Rate Notes due June 2012—

October 2018 $ 1,074 $ 1,382

8.00% Notes due May 2016 1,000 1,000

7.45% Debentures due August 2029 650 650

7.50% Notes due November 2014 490 490

6.34% to 7.15% Medium Term Notes due July 2012 – June 2028 440 440

8.00% Debentures due May 2031 400 400

7.50% Notes due May 2012 282 300

8.00% Debentures due June 2026 272 272

8.70% Debentures due May 2030 225 225

7.75% Debentures due June 2026 200 200

7.25% Notes due May 2013 140 200

7.90% Debentures due May 2017 96 96

Accounts Receivable Securitization Facility 55 90

Other 52 102

Net discount on debt, using an effective interest rate of 6.28% to 8.97% (216) (250)

Capital lease obligations 1,096 1,154

Total debt and capital lease obligations 6,256 6,751

Less current maturities of long-term debt and capital lease obligations (388) (403)

Long-term debt and capital lease obligations $ 5,868 $ 6,348

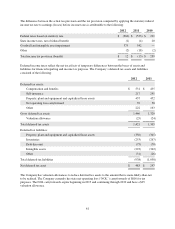

Future maturities of long-term debt, excluding the net discount on the debt and capital lease obligations, as of

February 25, 2012 consist of the following:

Fiscal Year

2013 $ 324

2014 196

2015 591

2016 591

2017 1,005

Thereafter 2,669

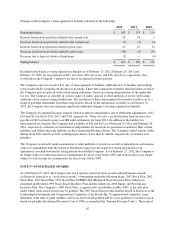

Certain of the Company’s credit facilities and long-term debt agreements have restrictive covenants and cross-

default provisions which generally provide, subject to the Company’s right to cure, for the acceleration of

payments due in the event of a breach of a covenant or a default in the payment of a specified amount of

indebtedness due under certain other debt agreements. The Company was in compliance with all such covenants

and provisions for all periods presented.

57