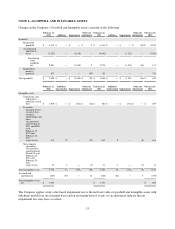

Albertsons 2012 Annual Report Download - page 51

Download and view the complete annual report

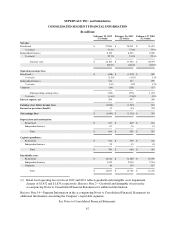

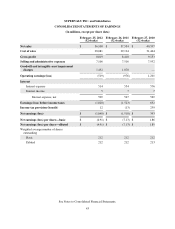

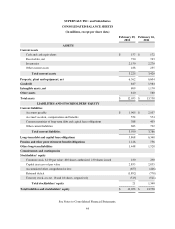

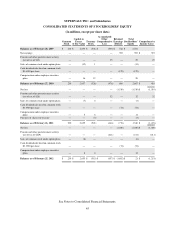

Please find page 51 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars and shares in millions, except per share data, unless otherwise noted)

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business Description

SUPERVALU INC. (“SUPERVALU” or the “Company”) is one of the largest companies in the United States

grocery channel. SUPERVALU conducts its retail operations under the Acme, Albertsons, Cub Foods, Farm

Fresh, Hornbacher’s, Jewel-Osco, Lucky, Save-A-Lot, Shaw’s, Shop ‘n Save, Shoppers Food & Pharmacy and

Star Market banners as well as in-store pharmacies under the Osco and Sav-on banners. Additionally, the

Company provides supply chain services, primarily wholesale distribution, across the United States retail grocery

channel.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and all its majority-owned

subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation.

References to the Company refer to SUPERVALU INC. and Subsidiaries.

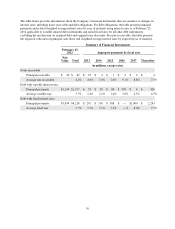

Fiscal Year

The Company’s fiscal year ends on the last Saturday in February. The Company’s first quarter consists of 16

weeks while the second, third and fourth quarters each consist of 12 weeks. Because of differences in the

accounting calendars of the Company and its wholly-owned subsidiary, New Albertsons, Inc., the February 25,

2012 and February 26, 2011 Consolidated Balance Sheets include the assets and liabilities related to New

Albertsons, Inc. as of February 23, 2012 and February 24, 2011, respectively. The last three fiscal years consist

of 52 week periods ended February 25, 2012, February 26, 2011 and February 27, 2010.

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with accounting principles

generally accepted in the United States of America (“accounting standards”) requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those estimates.

Revenue Recognition

Revenues from product sales are recognized at the point of sale for the Retail food segment and upon delivery for

the Independent business segment. Typically, invoicing, shipping, delivery and customer receipt of Independent

business product occur on the same business day. Revenues from services rendered are recognized immediately

after such services have been provided. Discounts and allowances provided to customers by the Company at the

time of sale, including those provided in connection with loyalty cards, are recognized as a reduction in Net sales

as the products are sold to customers. Sales tax is excluded from Net sales.

Revenues and costs from third-party logistics operations are recorded gross when the Company is the primary

obligor in a transaction, is subject to inventory or credit risk, has latitude in establishing price and selecting

suppliers, or has several, but not all of these indicators. If the Company is not the primary obligor and amounts

earned have little or no credit risk, revenue is recorded net as management fees earned.

47