Albertsons 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

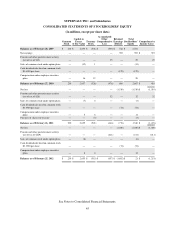

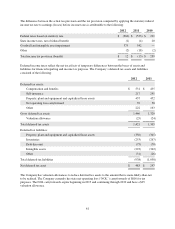

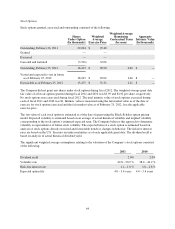

NOTE 3—RESERVES FOR CLOSED PROPERTIES AND PROPERTY, PLANT AND EQUIPMENT-

RELATED IMPAIRMENT CHARGES

Reserves for Closed Properties

Changes in the Company’s reserves for closed properties consisted of the following:

2012 2011 2010

Beginning balance $ 178 $ 128 $ 167

Additions 67313

Payments (56) (40) (48)

Adjustments 13 17 (4)

Ending balance $ 141 $ 178 $ 128

During fiscal 2011, the Company recorded additional reserves primarily related to the closure of non-strategic

stores announced and closed in the fourth quarter of fiscal 2011, which resulted in increased payments during

fiscal 2012. During fiscal 2010, the Company recorded additional reserves primarily related to the closure of

non-strategic stores announced and closed in fiscal 2009. Adjustments to reserves for closed properties are

primarily related to changes in subtenant income.

Property, Plant and Equipment-Related Impairment Charges

During fiscal 2012, the Company recorded $10 of property, plant and equipment-related impairment charges, of

which $1 was recorded in the fourth quarter. During fiscal 2011, the Company recorded $39 of property, plant

and equipment-related impairment charges, of which $24 were recorded in the fourth quarter as a result of the

closure of the non-strategic stores. During fiscal 2010, the Company recorded $52 of property, plant and

equipment-related impairment charges, of which $43 were recorded in the fourth quarter as a result of the

planned retail market exits.

Additions and adjustments to the reserves for closed properties and property, plant and equipment-related

impairment charges for fiscal 2012, 2011 and 2010 were primarily related to the Retail food segment, and were

recorded as a component of Selling and administrative expenses in the Consolidated Statements of Earnings.

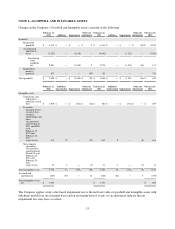

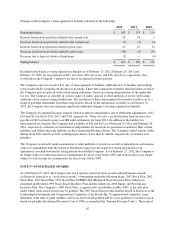

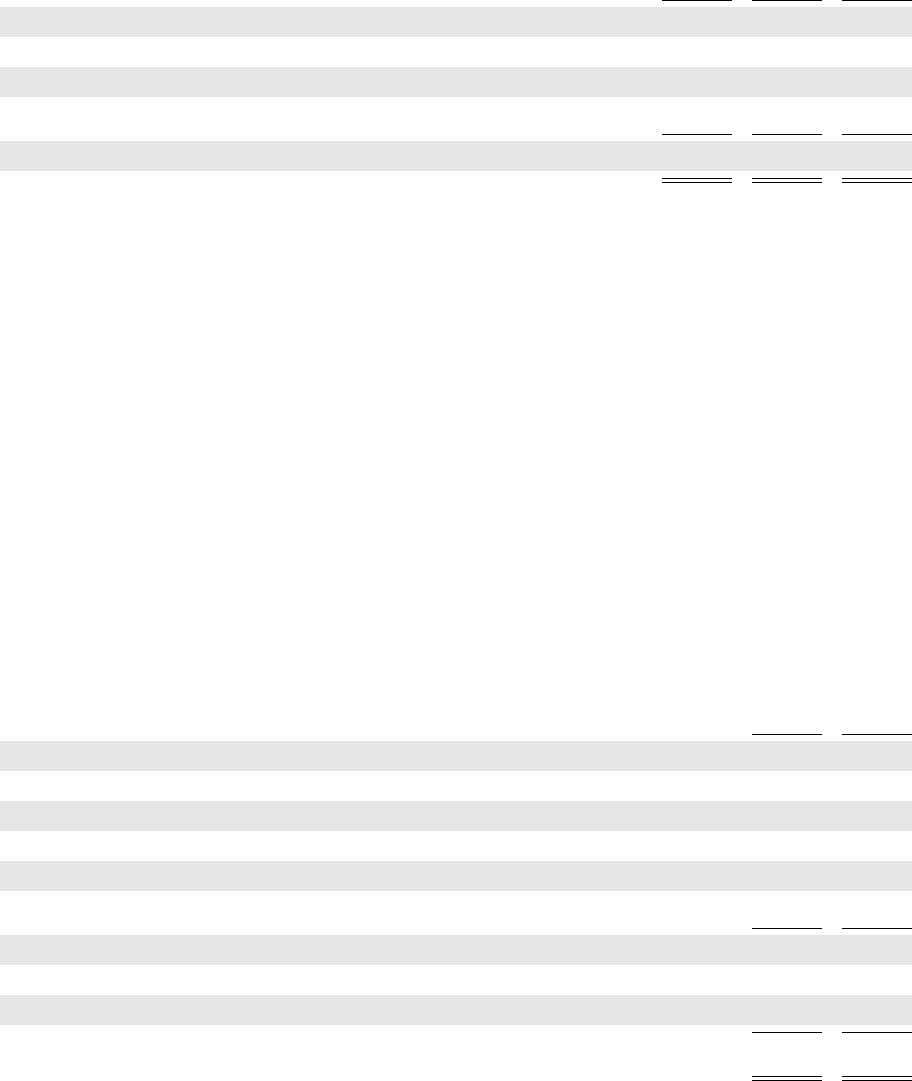

NOTE 4—PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment, net, consisted of the following:

2012 2011

Land $ 1,200 $ 1,260

Buildings 3,590 3,567

Property under construction 390 296

Leasehold improvements 1,672 1,627

Equipment 4,724 4,525

Capitalized lease assets 922 963

Total property plant and equipment 12,498 12,238

Accumulated depreciation (5,760) (5,263)

Accumulated amortization on capitalized lease assets (376) (371)

Total property, plant and equipment, net $ 6,362 $ 6,604

55