Albertsons 2012 Annual Report Download - page 60

Download and view the complete annual report

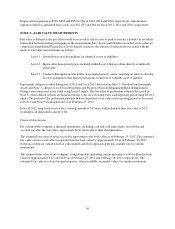

Please find page 60 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Depreciation expense was $790, $825 and $852 for fiscal 2012, 2011 and 2010, respectively. Amortization

expense related to capitalized lease assets was $52, $57 and $64 for fiscal 2012, 2011 and 2010, respectively.

NOTE 5—FAIR VALUE MEASUREMENTS

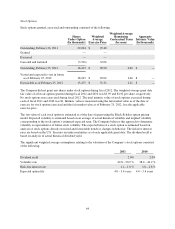

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. Assets and liabilities recorded at fair value are

categorized using defined hierarchical levels directly related to the amount of subjectivity associated with the

inputs to fair value measurements, as follows:

Level 1 - Quoted prices in active markets for identical assets or liabilities;

Level 2 - Inputs other than quoted prices included within Level 1 that are either directly or indirectly

observable;

Level 3 - Unobservable inputs in which little or no market activity exists, requiring an entity to develop

its own assumptions that market participants would use to value the asset or liability.

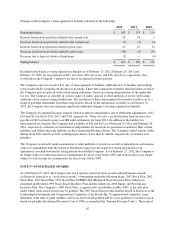

Impairment charges recorded during fiscal 2012 and fiscal 2011 discussed in Note 2—Goodwill and Intangible

Assets and Note 3—Reserves for Closed Properties and Property, Plant and Equipment-Related Impairment

Charges were measured at fair value using Level 3 inputs. The fair value of performance awards discussed in

Note 9—Stock-Based Awards are measured at fair value on a recurring basis each reporting period using Level 3

inputs. The portion of the performance awards that are measured at fair value each reporting period as discussed

in Note 1 and Note 9 are insignificant as of February 25, 2012.

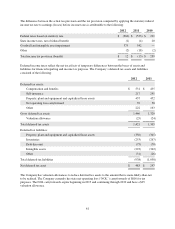

In fiscal 2012, long-lived assets with a carrying amount of $35 were written down to their fair value of $27,

resulting in an impairment charge of $8.

Financial Instruments

For certain of the Company’s financial instruments, including cash and cash equivalents, receivables and

accounts payable, the fair values approximate book values due to their short maturities.

The estimated fair value of notes receivable approximates the book value as of February 25, 2012. The estimated

fair value of notes receivable was greater than the book value by approximately $3 as of February 26, 2011.

Notes receivable are valued based on a discounted cash flow approach applying a market rate for similar

instruments.

The estimated fair value of the Company’s long-term debt (including current maturities) was less than the book

value by approximately $171 and $189 as of February 25, 2012 and February 26, 2011, respectively. The

estimated fair value was based on market quotes, where available, or market values for similar instruments.

56