Albertsons 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

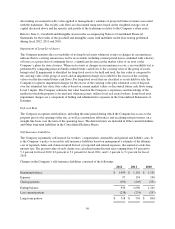

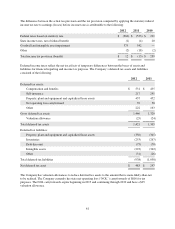

The Company leases certain property to third parties under both operating and direct financing leases. Under the

direct financing leases, the Company leases buildings to independent retail customers with terms ranging from

five to 20 years. Future minimum lease and subtenant rentals under noncancellable leases as of February 25,

2012 consist of the following:

Lease Receipts

Fiscal Year

Operating

Leases

Direct

Financing

Leases

2013 $23$ 3

2014 15 2

2015 10 2

2016 91

2017 71

Thereafter 12 1

Total minimum lease receipts $ 76 10

Less unearned income (2)

Net investment in direct financing leases 8

Less current portion (2)

Long-term portion $6

The carrying value of owned property leased to third parties under operating leases was as follows:

2012 2011

Property, plant and equipment $ 25 $ 24

Less accumulated depreciation (8) (6)

Property, plant and equipment, net $ 17 $ 18

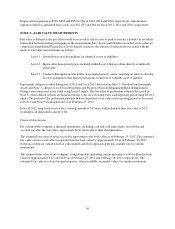

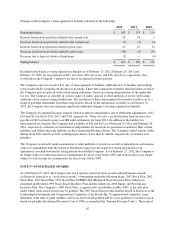

NOTE 8—INCOME TAXES

The provision for income taxes consisted of the following:

2012 2011 2010

Current

Federal $ 71 $ 2 $ 65

State 14 — 9

Total current 85 2 74

Deferred (73) (15) 165

Total income tax provision (benefit) $ 12 $ (13) $ 239

60