Albertsons 2012 Annual Report Download - page 21

Download and view the complete annual report

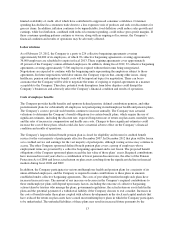

Please find page 21 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Carolina Services, in the United States District Court in the Eastern District of Wisconsin. The plaintiffs in the

case are a consumer goods manufacturer, a grocery co-operative and a retailer marketing services company who

allege on behalf of a purported class that the Company and the other defendants (i) conspired to restrict the

markets for coupon processing services under the Sherman Act and (ii) were part of an illegal enterprise to

defraud the plaintiffs under the Federal Racketeer Influenced and Corrupt Organizations Act. The plaintiffs seek

monetary damages, attorneys’ fees and injunctive relief. The Company intends to vigorously defend this lawsuit,

however all proceedings have been stayed in the case pending the result of the criminal prosecution of certain

former officers of IOS.

In December 2008, a class action complaint was filed in the United States District Court for the Western District

of Wisconsin against the Company alleging that a 2003 transaction between the Company and C&S Wholesale

Grocers, Inc. (“C&S”) was a conspiracy to restrain trade and allocate markets. In the 2003 transaction, the

Company purchased certain assets of the Fleming Corporation as part of Fleming Corporation’s bankruptcy

proceedings and sold certain assets of the Company to C&S which were located in New England. Since

December 2008, three other retailers have filed similar complaints in other jurisdictions. The cases have been

consolidated and are proceeding in the United States District Court for the District of Minnesota. The complaints

allege that the conspiracy was concealed and continued through the use of non-compete and non-solicitation

agreements and the closing down of the distribution facilities that the Company and C&S purchased from the

other. Plaintiffs are seeking monetary damages, injunctive relief and attorneys’ fees. The Company is vigorously

defending these lawsuits. Separately from these civil lawsuits, on September 14, 2009, the United States Federal

Trade Commission (“FTC”) issued a subpoena to the Company requesting documents related to the C&S

transaction as part of the FTC’s investigation into whether the Company and C&S engaged in unfair methods of

competition. The Company cooperated with the FTC. On March 18, 2011, the FTC notified the Company that it

has determined that no additional action is warranted by the FTC and that it has closed its investigation.

Predicting the outcomes of claims and litigation and estimating related costs and exposures involves substantial

uncertainties that could cause actual outcomes, costs and exposures to vary materially from current expectations.

The Company regularly monitors its exposure to the loss contingencies associated with these matters and may

from time to time change its predictions with respect to outcomes and its estimates with respect to related costs

and exposures. With respect to the two matters discussed above, the Company believes the chance of a negative

outcome is remote. It is possible, although management believes it is remote, that material differences in actual

outcomes, costs and exposures relative to current predictions and estimates, or material changes in such

predictions or estimates, could have a material adverse effect on the Company’s financial condition, results of

operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

17