Albertsons 2012 Annual Report Download - page 33

Download and view the complete annual report

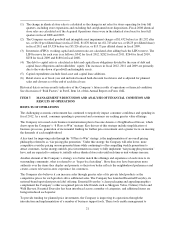

Please find page 33 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Reserves for Closed Properties and Property, Plant and Equipment-Related Impairment Charges

The Company maintains reserves for costs associated with closures of retail stores, distribution centers and other

properties that are no longer being utilized in current operations. The Company provides for closed property

operating lease liabilities using a discount rate to calculate the present value of the remaining noncancellable

lease payments after the closing date, reduced by estimated subtenant rentals that could be reasonably obtained

for the property. The closed property lease liabilities usually are paid over the remaining lease terms, which

generally range from one to 20 years. The Company estimates subtenant rentals and future cash flows based on

the Company’s experience and knowledge of the market in which the closed property is located, the Company’s

previous efforts to dispose of similar assets and existing economic conditions. Adjustments to closed property

reserves primarily relate to changes in subtenant income or actual exit costs differing from original estimates.

Adjustments are made for changes in estimates in the period in which the changes become known.

Owned properties, capital lease properties and the related equipment and leasehold improvements at operating

leased properties that are closed are reduced to their estimated fair value. The Company estimates fair value

based on its experience and knowledge of the market in which the closed property is located and, when

necessary, utilizes local real estate brokers to assist in the valuation.

The expectations on timing of disposition and the estimated sales price or subtenant rentals associated with

closed properties, owned or leased, are impacted by variable factors including inflation, the general health of the

economy, resultant demand for commercial property, the ability to secure subleases, the creditworthiness of

sublessees and the Company’s success at negotiating early termination agreements with lessors. While

management believes the current estimates of reserves for closed properties and related impairment charges are

adequate, it is possible that market and economic conditions in the real estate market could cause changes in the

Company’s assumptions and may require additional reserves and asset impairment charges to be recorded.

The Company’s reserve for closed properties was $141, net of estimated sublease recoveries of $150, as of

February 25, 2012 and $178, net of estimated sublease recoveries of $142, as of February 26, 2011. The

Company recognized asset impairment charges of $10, $39 and $52 in fiscal 2012, 2011 and 2010, respectively.

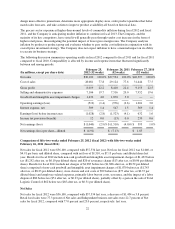

Goodwill and Intangible Assets with Indefinite Useful Lives

The Company reviews goodwill for impairment during the fourth quarter of each year, and also if an event occurs

or circumstances change that would more-likely-than-not reduce the fair value of a reporting unit below its

carrying amount. The reviews consist of comparing estimated fair value to the carrying value at the reporting unit

level. The Company’s determination of reporting units considers the quantitative and qualitative characteristics

of aggregation of each of the components within the traditional retail stores and independent business operating

segments. The significant qualitative and economic characteristics used in determining our components to

support their aggregation include types of businesses and the manner in which the components operate,

consideration of key impacts to net sales, cost of sales, competitive risks and the extent to which components

share assets and other resources. The Company’s reporting units are the operating segments of the business

which consist of traditional retail stores, hard-discount stores, and independent business services.

The Company’s traditional retail stores reporting unit is comprised of the aggregation of ten traditional retail

food store components under a variety of banners, including Shoppers, Jewel-Osco, ACME, Albertson’s

Southern California, Albertson’s Inter-Mountain West, Hornbachers, Farm Fresh, Cub Foods, Shop’n Save and

Shaw’s. The Company’s hard-discount stores reporting unit is comprised of a single component under one

banner: Save-A-Lot. The independent business reporting unit is comprised of the aggregation of four geographic

distribution areas, which are organized based on region components: Eastern, Southeast, Midwest and Northern.

The fair values of the Company’s reporting units are determined by using both the market approach, applying a

multiple of earnings based on guidelines for publicly traded companies, and the income approach, discounting

projected future cash flows based on management’s expectations of the current and future operating

environment. The rates used to discount projected future cash flows reflect a weighted average cost of capital

29