Albertsons 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

The Company’s current and deferred tax provision is based on estimates and assumptions that could materially

differ from the actual results reflected in its income tax returns filed during the subsequent year and could

significantly affect the effective tax rate and cash flows in future years.

The Company recognizes deferred tax assets and liabilities for the expected tax consequences of temporary

differences between the tax bases of assets and liabilities and their reported amounts using enacted tax rates in

effect for the year in which it expects the differences to reverse.

The Company’s effective tax rate is influenced by tax planning opportunities available in the various

jurisdictions in which the Company operates. Management’s judgment is involved in determining the effective

tax rate and in evaluating the ultimate resolution of any uncertain tax positions. In addition, the Company is

currently in various stages of audits, appeals or other methods of review with taxing authorities from various

taxing jurisdictions. The Company establishes liabilities for unrecognized tax benefits in a variety of taxing

jurisdictions when, despite management’s belief that the Company’s tax return positions are supportable, certain

positions may be challenged and may need to be revised. The Company adjusts these liabilities in light of

changing facts and circumstances, such as the progress of a tax audit. The effective income tax rate includes the

impact of reserve provisions and changes to those reserves. The Company also provides interest on these

liabilities at the appropriate statutory interest rate. The actual benefits ultimately realized for tax positions may

differ from the Company’s estimates due to changes in facts, circumstances and new information. As of

February 25, 2012 and February 26, 2011, the Company had $165 and $182 of unrecognized tax benefits,

respectively.

The Company records a valuation allowance to reduce the deferred tax assets to the amount that it is more-likely-

than-not to realize. Forecasted earnings, future taxable income and future prudent and feasible tax planning

strategies are considered in determining the need for a valuation allowance. In the event the Company was not

able to realize all or part of its net deferred tax assets in the future, the valuation allowance would be increased.

Likewise, if it was determined that the Company was more-likely-than-not to realize the net deferred tax assets,

the applicable portion of the valuation allowance would reverse. The Company had a valuation allowance of $25

and $24 as of February 25, 2012 and February 26, 2011, respectively.

LIQUIDITY AND CAPITAL RESOURCES

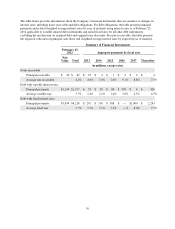

Net cash provided by operating activities was $1,056, $1,163 and $1,474 in fiscal 2012, 2011 and 2010,

respectively. The decrease in cash provided by operating activities in fiscal 2012 compared to fiscal 2011 is

primarily attributable to changes in operating assets and liabilities, and Net loss, adjusted for the impact of

non-cash impairment charges. The decrease in cash provided by operating activities in fiscal 2011 compared to

fiscal 2010 is primarily attributable to changes in deferred income taxes, operating assets and liabilities, and Net

loss, adjusted for the impact of non-cash impairment charges.

Net cash used in investing activities was $484, $227 and $459 in fiscal 2012, 2011 and 2010, respectively. The

increase in cash used in investing activities in fiscal 2012 compared to fiscal 2011 is primarily attributable to

decreased proceeds from the sale of assets and increased cash used in the purchases of property, plant and

equipment in fiscal 2012. The decrease in cash used in investing activities in fiscal 2011 compared to fiscal 2010

is primarily attributable to higher proceeds from the sale of assets and lower capital spending in fiscal 2011.

Net cash used in financing activities was $587, $975 and $1,044 in fiscal 2012, 2011 and 2010, respectively. The

decrease in cash used in financing activities in fiscal 2012 compared to fiscal 2011 is primarily attributable to

lower net debt and capital lease payments in fiscal 2012. The decrease in cash used in financing activities in

fiscal 2011 compared to fiscal 2010 is primarily attributable to lower dividends paid in fiscal 2011 compared to

fiscal 2010.

33