Albertsons 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.limited availability of credit, all of which have contributed to suppressed consumer confidence. Consumer

spending has declined as consumers trade down to a less expensive mix of products and seek out discounters for

grocery items. In addition, inflation continues to be unpredictable; food deflation could reduce sales growth and

earnings, while food inflation, combined with reduced consumer spending, could reduce gross profit margins. If

these consumer spending patterns continue or worsen, along with an ongoing soft economy, the Company’s

financial condition and results of operations may be adversely affected.

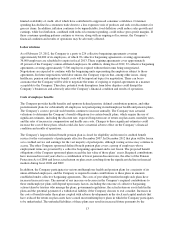

Labor relations

As of February 25, 2012, the Company is a party to 224 collective bargaining agreements covering

approximately 84,000 of its employees, of which 76 collective bargaining agreements covering approximately

36,000 employees are scheduled to expire in fiscal 2013. These expiring agreements cover approximately

42 percent of the Company’s union-affiliated employees. In addition, during fiscal 2012, 32 collective bargaining

agreements covering approximately 5,500 employees expired without their terms being renegotiated.

Negotiations are expected to continue with the bargaining units representing the employees subject to those

agreements. In future negotiations with labor unions, the Company expects that, among other issues, rising

healthcare, pension and employee benefit costs will be important topics for negotiation. There can be no

assurance that the Company will be able to negotiate the terms of expiring or expired agreements in a manner

acceptable to the Company. Therefore, potential work disruptions from labor disputes could disrupt the

Company’s businesses and adversely affect the Company’s financial condition and results of operations.

Costs of employee benefits

The Company provides health benefits and sponsors defined pension, defined contribution pension, and other

postretirement plans for substantially all employees not participating in multiemployer health and pension plans.

The Company’s costs to provide such benefits continue to increase annually. The Company uses actuarial

valuations to determine the Company’s benefit obligations for certain benefit plans, which require the use of

significant estimates, including the discount rate, expected long-term rate of return on plan assets, mortality rates,

and the rates of increase in compensation and health care costs. Changes to these significant estimates could

increase the cost of these plans, which could also have a material adverse effect on the Company’s financial

condition and results of operations.

The Company’s largest defined benefit pension plan is closed for eligibility and frozen for credited benefit

service for the vast majority of participants effective December 2007. In December 2012 that plan will be frozen

as to credited service and earnings for the vast majority of participants, although vesting service may continue to

accrue. The other Company sponsored defined benefit pension plan covers a group of employees whose

employment terms are governed by a collective bargaining agreement and is not frozen. The projected benefit

obligations of the Company sponsored plans exceed the fair value of those plans’ assets. Required contributions

have increased in recent years due to a combination of lower pension discount rates, the effect of the Pension

Protection Act of 2006 and lower actual return on plan assets resulting from the significant decline in financial

markets during fiscal 2008 and 2009.

In addition, the Company participates in various multiemployer health and pension plans for a majority of its

union-affiliated employees, and the Company is required to make contributions to these plans in amounts

established under collective bargaining agreements. The costs of providing benefits through such plans have

increased in recent years. The amount of any increase or decrease in the Company’s required contributions to

these multiemployer plans will depend upon many factors, including the outcome of collective bargaining,

actions taken by trustees who manage the plans, government regulations, the actual return on assets held in the

plans and the potential payment of a withdrawal liability if the Company chooses to exit a market. Increases in

the costs of benefits under these plans coupled with adverse developments in the stock and capital markets that

have reduced the return on plan assets have caused most multiemployer plans in which the Company participates

to be underfunded. The unfunded liabilities of these plans may result in increased future payments by the

13