Albertsons 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

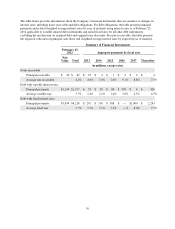

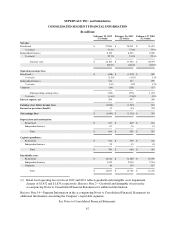

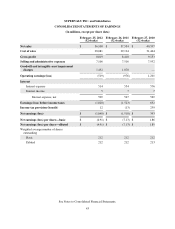

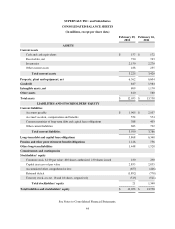

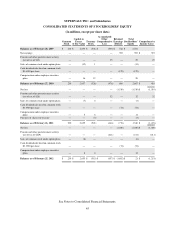

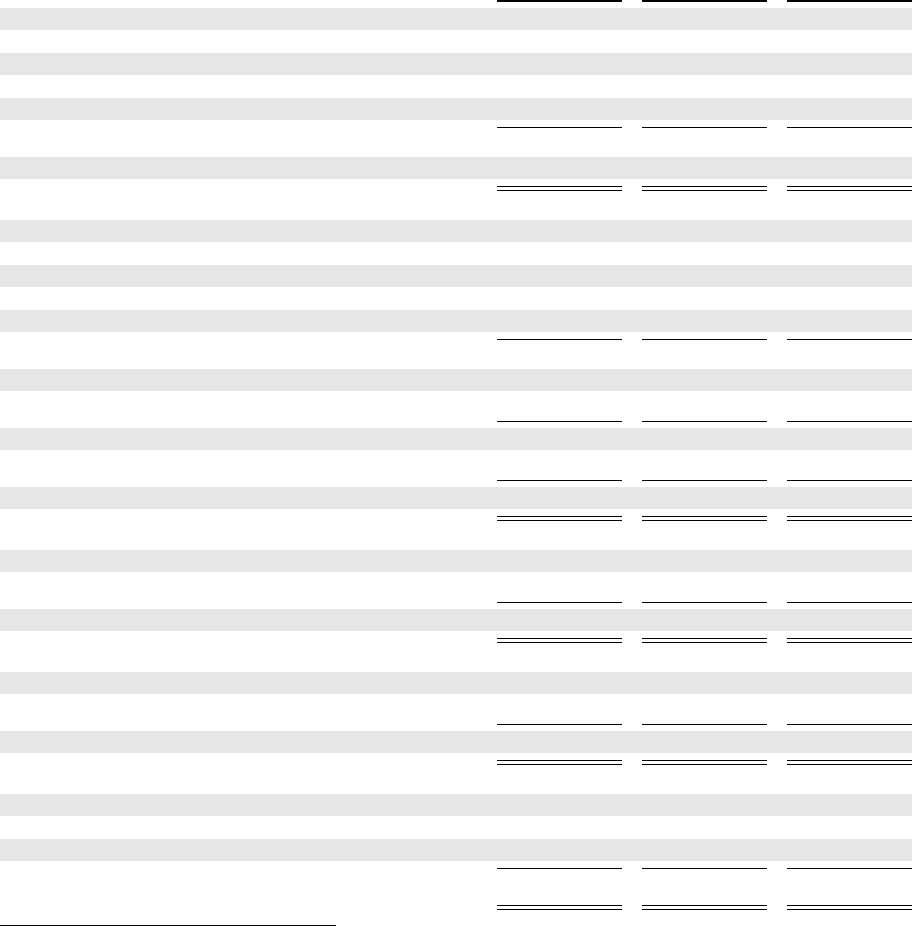

SUPERVALU INC. and Subsidiaries

CONSOLIDATED SEGMENT FINANCIAL INFORMATION

(In millions)

February 25, 2012

(52 weeks)

February 26, 2011

(52 weeks)

February 27, 2010

(52 weeks)

Net sales

Retail food $ 27,906 $ 28,911 $ 31,637

% of total 77.3% 77.0% 77.9%

Independent business 8,194 8,623 8,960

% of total 22.7% 23.0% 22.1%

Total net sales $ 36,100 $ 37,534 $ 40,597

100.0% 100.0% 100.0%

Operating earnings (loss)

Retail food (1) $ (698) $ (1,212) $ 989

% of sales (2.5)% (4.2)% 3.1%

Independent business 243 337 299

% of sales 3.0% 3.9% 3.3%

Corporate (64) (101) (87)

Total operating earnings (loss) (519) (976) 1,201

% of sales (1.4)% (2.6)% 3.0%

Interest expense, net 509 547 569

Earnings (loss) before income taxes (1,028) (1,523) 632

Income tax provision (benefit) 12 (13) 239

Net earnings (loss) $ (1,040) $ (1,510) $ 393

Depreciation and amortization

Retail food $ 817 $ 849 $ 876

Independent business 67 76 81

Total $ 884 $ 925 $ 957

Capital expenditures

Retail food $ 641 $ 559 $ 642

Independent business 59 45 49

Total $ 700 $ 604 $ 691

Identifiable assets

Retail food $ 10,014 $ 11,589 $ 14,035

Independent business 1,955 2,050 2,214

Corporate 84 119 187

Total $ 12,053 $ 13,758 $ 16,436

(1) Retail food operating loss for fiscal 2012 and 2011 reflects goodwill and intangible asset impairment

charges of $1,432 and $1,870, respectively. Refer to Note 2—Goodwill and Intangible Assets in the

accompanying Notes to Consolidated Financial Statements for additional information.

Refer to Note 14—Segment Information in the accompanying Notes to Consolidated Financial Statements for

additional information concerning the Company’s reportable segments.

See Notes to Consolidated Financial Statements.

42