Albertsons 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

Deferred income taxes represent future net tax effects resulting from temporary differences between the financial

statement and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the

differences are expected to be settled or realized.

The Company is currently in various stages of audits, appeals or other methods of review with taxing authorities

from various taxing jurisdictions. The Company establishes liabilities for unrecognized tax benefits in a variety

of taxing jurisdictions when, despite management’s belief that the Company’s tax return positions are

supportable, certain positions may be challenged and may need to be revised. The Company adjusts these

liabilities in light of changing facts and circumstances, such as the progress of a tax audit. The Company also

provides interest on these liabilities at the appropriate statutory interest rate. The Company recognizes interest

related to unrecognized tax benefits in interest expense and penalties in Selling and administrative expenses in

the Consolidated Statements of Earnings.

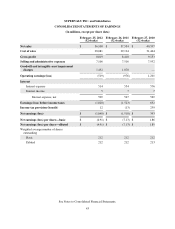

Net Earnings (Loss) Per Share

Basic net earnings (loss) per share is calculated using net earnings (loss) available to stockholders divided by the

weighted average number of shares outstanding during the period. Diluted net earnings (loss) per share is similar

to basic net earnings (loss) per share except that the weighted average number of shares outstanding is

determined after giving effect to the dilutive impacts of stock options, restricted stock awards and outstanding

convertible securities. In addition, for the calculation of diluted net earnings (loss) per share, net earnings (loss) is

adjusted to eliminate the after-tax interest expense recognized during the period related to contingently

convertible debentures if dilutive.

Reclassifications

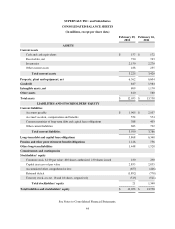

Certain prior year amounts in the Company’s Consolidated Statement of Cash Flows and Consolidated Balance

Sheets have been reclassified to conform with to the current year’s presentation.

Recently Adopted Accounting Standards

In September 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

No. 2011-09, Compensation—Retirement Benefits—Multiemployer Plans (Subtopic 715-80) (“ASU 2011-09”).

This accounting standard provides guidance on disclosure requirements for employers participating in

multiemployer pension and other postretirement benefit plans (multiemployer plans) to improve transparency and

increase awareness of the commitments and risks involved with participation in multiemployer plans. The new

guidance requires employers participating in multiemployer plans to provide additional quantitative and

qualitative disclosures to provide users with more detailed information regarding an employer’s involvement in

multiemployer plans. The Company adopted the standard effective February 25, 2012. Refer to Note 12 – Benefit

Plans in the accompanying Notes to Consolidated Financial Statements for additional information on the

Company’s participation in these multiemployer pension plans. The adoption of this new standard resulted in

enhanced disclosures, but otherwise did not have an impact on the Company’s Consolidated Financial

Statements.

52