Albertsons 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

ITEM 1. BUSINESS

General

SUPERVALU INC. (“SUPERVALU” or the “Company”), a Delaware corporation, was organized in 1925 as the

successor to two wholesale grocery firms established in the 1870’s. The Company’s principal executive offices

are located at 7075 Flying Cloud Drive, Eden Prairie, Minnesota 55344 (Telephone: 952-828-4000). All

references to the “Company,” “we,” “us,” “our” and “SUPERVALU” relate to SUPERVALU INC. and its

majority-owned subsidiaries.

SUPERVALU is one of the largest companies in the United States retail grocery channel. Additionally, the

Company is one of the largest wholesale distributors to Independent retail customers across the United States.

On June 2, 2006, the Company acquired New Albertson’s, Inc. (“New Albertsons”) consisting of the core

supermarket businesses (the “Acquired Operations”) formerly owned by Albertson’s, Inc. (“Albertsons”)

operating approximately 1,125 stores under the banners of Acme, Albertsons, Jewel-Osco, Shaw’s, Star Market,

the related in-store pharmacies under the Osco and Sav-on banners, 10 distribution centers and certain regional

and corporate offices (the “Acquisition”). As part of the Acquisition, the Company acquired the Acme,

Albertsons, Jewel, Osco, Sav-on and Shaw’s trademarks and tradenames (the “Acquired Trademarks”). The

Acquisition greatly increased the size of the Company.

SUPERVALU is focused on long-term retail growth through business transformation to meet the demands of

each neighborhood the Company serves, and targeted store remodels and new store development in the hard-

discount format. During fiscal 2012, the Company added 83 new stores through new store development and

closed or sold 43 stores, including planned disposals. The Company leverages its distribution operations by

providing wholesale distribution and logistics and service solutions to its independent retail customers through its

Independent business segment.

The Company makes available free of charge at its internet website (www.supervalu.com) its annual reports on

Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports

filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”) as soon as reasonably practicable after such material is electronically filed with or furnished to

the Securities and Exchange Commission (the “SEC”). Information on the Company’s website is not deemed to

be incorporated by reference into this Annual Report on Form 10-K. The Company will also provide its SEC

filings free of charge upon written request to Investor Relations, SUPERVALU INC., P.O. Box 990,

Minneapolis, MN 55440.

All dollar and share amounts in this Annual Report on Form 10-K are in millions, except per share data and

where otherwise noted.

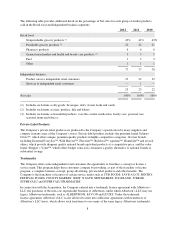

Financial Information About Reportable Segments

The Company’s business is classified by management into two reportable segments: Retail food and Independent

business (formerly Supply chain services). These reportable segments are two distinct businesses, one retail and

one wholesale, each with a different customer base, marketing strategy and management structure. The Retail

food reportable segment is an aggregation of the Company’s two retail operating segments, which are organized

based on format (traditional retail food stores and hard-discount food stores). The Retail food reportable segment

derives revenues from the sale of groceries at retail locations operated by the Company (both the Company’s own

stores and stores licensed by the Company). The Independent business reportable segment derives revenues from

wholesale distribution to independently-owned retail food stores and other customers (collectively referred to as

“independent retail customers”). Substantially all of the Company’s operations are domestic. Refer to the

Consolidated Segment Financial Information set forth in Part II, Item 8 of this Annual Report on Form 10-K for

financial information concerning the Company’s operations by reportable segment.

6