Albertsons 2012 Annual Report Download - page 36

Download and view the complete annual report

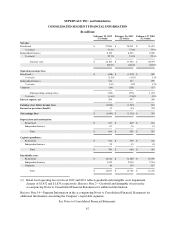

Please find page 36 of the 2012 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company accounts for its defined benefit pension and other postretirement benefit plans in accordance with

Accounting Standard Codification (ASC) 715, Compensation—Retirement Benefits, in measuring plan assets and

benefit obligations and in determining the amount of net periodic benefit cost. ASC 715 requires employers to

recognize the underfunded or overfunded status of a defined benefit pension or postretirement plan as an asset or

liability in its statement of financial position and recognize changes in the funded status in the year in which the

changes occur through accumulated other comprehensive loss, which is a component of stockholders’ equity.

While the company believes the valuation methods used to determine the fair value of plan assets are appropriate

and consistent with other market participants, the use of different methodologies or assumptions to determine the

fair value of certain financial instruments could result in a different estimate of fair value at the reporting date.

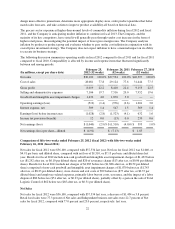

The determination of the Company’s obligation and related expense for Company-sponsored pension and other

postretirement benefits is dependent, in part, on management’s selection of certain actuarial assumptions used in

calculating these amounts. These assumptions include, among other things, the discount rate, the expected long-

term rate of return on plan assets and the rates of increase in compensation and healthcare costs. See Note

12-Benefit Plans for additional discussion of actuarial assumptions used in determining pension and

postretirement health care liabilities and expenses.

The Company reviews and selects the discount rate to be used in connection with its pension and other

postretirement obligations annually. The discount rate reflects the current rate at which the associated liabilities

could be effectively settled at the end of the year. The Company sets its rate to reflect the yield of a portfolio of

high quality, fixed-income debt instruments that would produce cash flows sufficient in timing and amount to

settle projected future benefits.

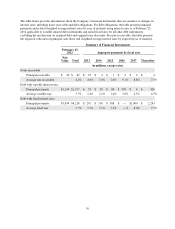

The Company’s expected long-term rate of return on plan assets assumption is determined based on the

portfolio’s actual and target composition, current market conditions, forward-looking return and risk assumptions

by asset class, and historical long-term investment performance. The 10-year annual average rate of return on

pension assets for fiscal 2012 and fiscal 2011 are lower than the assumed long-term rate of return of 7.5 and 7.75

percent due to the unprecedented decline in the economy and the credit market turmoil during fiscal 2008 and

2009. The 10 year rolling average annualized return for investments made in a manner consistent with our target

allocations have generated average returns of approximately 8.2% based on returns from 1990 to 2011. The

Company expects that the markets will recover to the assumed long-term rate of return. In accordance with

accounting standards, actual results that differ from the Company’s assumptions are accumulated and amortized

over future periods and, therefore, affect expense and obligations in future periods.

At February 25, 2012, the Company converted to the 2012 Static Mortality Table for Annuitants and

Non-Annuitants for calculating the pension and postretirement obligations and the fiscal 2013 expense. The

impact of this change increased the February 25, 2012 projected benefit obligation by $10 and the accumulated

postretirement benefit obligation by $1. This change will also increase the fiscal 2013 defined benefit pension

plans expense by $2.

During fiscal 2012, the Company contributed $87, as $63 was pre-funded in fiscal 2011, to its defined benefit

pension plans. In addition the Company contributed $6 to its postretirement benefit plans in fiscal 2012, and

expects to contribute $168 to its defined benefit pension plans and $7 to its postretirement benefit plans in fiscal

2013.

For fiscal 2013, each 25 basis point reduction in the discount rate would increase pension expense by approximately

$14 and each 25 basis point reduction in expected return on plan assets would increase pension expense by

approximately $5. Similarly, for postretirement benefits, a 100 basis point increase in the healthcare cost trend rate

would increase the accumulated postretirement benefit obligation as of the end of fiscal 2012 by approximately $11.

Conversely, a 100 basis point decrease in the healthcare cost trend rate would decrease the accumulated

postretirement benefit obligation as of the end of fiscal 2012 by approximately $10. A 100 basis point change in the

healthcare trend rate would impact service and interest cost by $1. Although the Company believes that its

assumptions are appropriate, the actuarial assumptions may differ from actual results due to changing market and

economic conditions, higher or lower withdrawal rates and longer or shorter life spans of participants.

32