eBay 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of the Skype earn out settlement payment and was determined by comparing the carrying value of goodwill in our

Communications reporting unit with the implied fair value of the goodwill. We determined the fair value of the

Communications reporting unit using the income approach, which requires estimates of future operating results and

cash flows discounted using an estimated discount rate. Our estimates resulted from an updated long-term financial

outlook developed as part of our strategic planning cycle conducted annually during our third quarter. Our estimates

of future operating results for our Communications reporting unit are for an early stage business with limited

financial history, as well as developing revenue models. These factors increase the risk of differences between

projected and actual performance that could impact future estimates of fair value of the Communications reporting

unit.

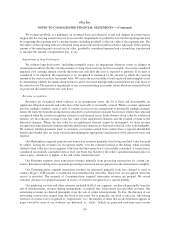

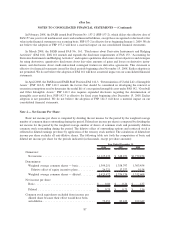

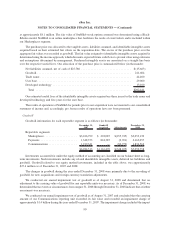

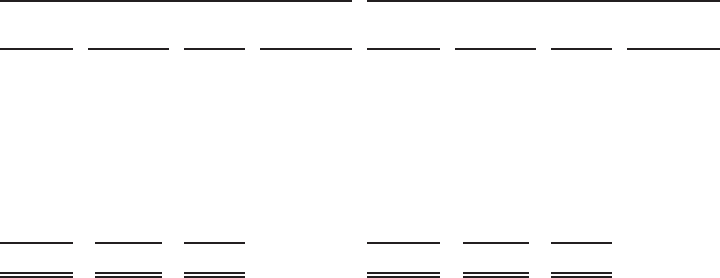

Intangible Assets

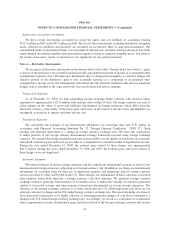

The components of acquired identifiable intangible assets are as follows (in thousands):

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Weighted

Average Useful

Life

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Weighted

Average Useful

Life

December 31, 2007 December 31, 2008

(years) (years)

Intangible assets:

Customer lists and user

base............ $ 588,714 $(334,864) $253,850 6 $ 756,829 $(415,238) $341,591 6

Trademarks and trade

names .......... 572,918 (292,854) 280,064 5 638,930 (393,353) 245,577 5

Developed

technologies . . . . . . 125,504 (85,441) 40,063 4 199,893 (111,973) 87,920 3

Allother............ 62,052 (38,546) 23,506 4 126,381 (64,803) 61,578 4

$1,349,188 $(751,705) $597,483 $1,722,033 $(985,367) $736,666

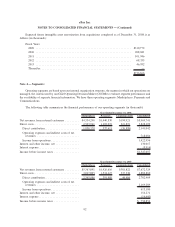

All of our acquired identifiable intangible assets are subject to amortization. Acquired identifiable intangible

assets are comprised of customer lists and user base, trademarks and trade names, developed technologies, and other

acquired intangible assets including patents and contractual agreements. No significant residual value is estimated

for the intangible assets. The increase in intangible assets during the year ended December 31, 2008 resulted

primarily from certain intangible assets acquired as part of our acquisition of the outstanding shares of Bill Me

Later, Den Bla

˚Avis and BilBasen, and Fraud Sciences as well as other acquisitions completed during the year. The

net carrying amount of intangible assets related to our equity investments, included in the table above, totaled

approximately $1.4 million and $0.5 million, as of December 31, 2007 and 2008, respectively. Aggregate

amortization expense for intangible assets totaled $220.0 million, $229.2 million and $281.6 million for the years

ended December 31, 2006, 2007 and 2008, respectively. Included in amortization of intangibles for the year ended

December 31, 2008, is a charge of $9.0 million for in-process research and development related to an asset purchase

completed during the period.

91

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)