eBay 2008 Annual Report Download - page 58

Download and view the complete annual report

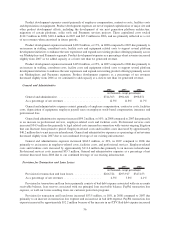

Please find page 58 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.income in the first quarter of 2009 to be lower than the first quarter of 2008 due primarily to the effect of an

anticipated stronger U.S. dollar as well as the negative impact of the economic environment on consumer spending

and the challenges associated with reaccelerating growth of GMV in our Marketplaces core business. Although the

current economic environment makes it difficult to predict the impact on individual types of expenses, we expect

that cost controls, including our previously-announced restructuring that impacts our employee related operating

expenses, will partially offset the negative effects of an anticipated year-over-year decline in revenues and our

expected investments in our higher growth businesses such as Payments, Classifieds and Communications. We also

expect diluted earnings per share will be negatively impacted by lower interest rates and from dilution resulting

from recent acquisitions.

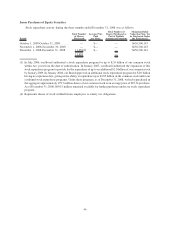

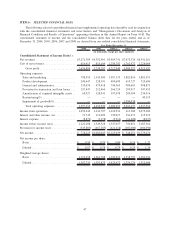

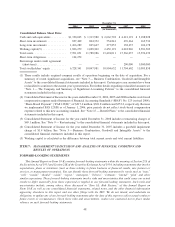

Results of Operations

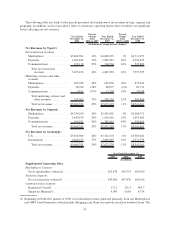

Net Revenues

Our net transaction revenues from our Marketplaces segment are derived primarily from listing and final value

fees paid by sellers. For our Payments segment, net transaction revenues are generated primarily by fees paid by

merchants for payment processing services. Our Communications segment net transaction revenues are generated

primarily from fees charged to users to connect Skype’s VoIP product to traditional fixed-line and mobile

telephones. These fees are charged on a per-minute basis or on a subscription basis and we refer to these minutes

as SkypeOut minutes.

Our marketing services and other revenue are generated from all three of our business segments. Our

marketing services are derived principally from the sale of advertisements, revenue sharing arrangements,

classifieds fees, lead referral fees. Our other revenues are derived principally from interest earned from banks

on certain PayPal customer account balances, interest and fees earned on the Bill Me Later loan portfolio and from

contractual arrangements with third parties that provide services to all of our users.

Revenues are attributed to U.S. and international geographies primarily based upon the country in which the

seller, payment recipient, customer, Skype user’s Internet protocol address, online property that generates adver-

tising, or other service provider, as the case may be, is located. Because we generate the majority of our revenue

internationally, fluctuations in foreign currency exchange rates will impact our results of operations. Based on

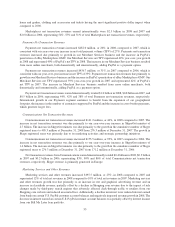

changes in foreign currency rates year over year, total net revenues for the year ended December 31, 2008 were

positively impacted by foreign currency translation of approximately $190.9 million compared to the prior year. On

a business segment basis, Marketplaces, Payments and Communications total net revenues for the year ended

December 31, 2008 were positively impacted by foreign currency translation of approximately $158.8 million,

$0.3 million and $31.8 million, respectively. Total net revenues for the year ended December 31, 2007 were

positively impacted by foreign currency translation of approximately $276.0 million compared to the prior year. On

a business segment basis, Marketplaces, Payments and Communications total net revenues for the year ended

December 31, 2007 were positively impacted by foreign currency translation of approximately $222.4 million,

$21.4 million and $32.2 million, respectively. Impact of foreign currency translation only includes changes between

our functional currencies and our U.S. dollar reporting currency.

50