eBay 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

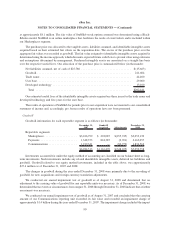

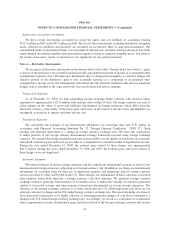

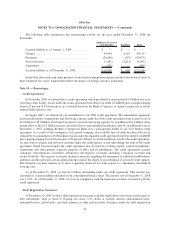

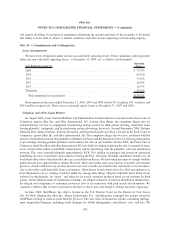

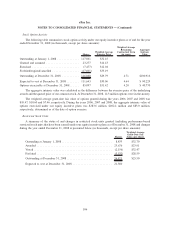

The following table summarizes the restructuring activity for the year ended December 31, 2008 (in

thousands):

Employee Severance

and Benefits Facilities Total

Accrued liability as of January 1, 2008 .............. $ — $ — $ —

Charges ..................................... 44,954 4,165 49,119

Payments .................................... (29,068) (407) (29,475)

Non-cash items ................................ (1,281) (2,812) (4,093)

Adjustment ................................... (405) — (405)

Accrued liability as of December 31, 2008 . .......... $14,200 $ 946 $15,146

In the table above non-cash items pertain to stock-based compensation expense and the write-down of assets to

their estimated fair value. Adjustments reflect the impact of foreign currency translation.

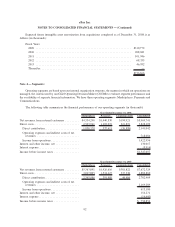

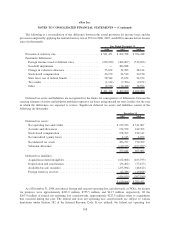

Note 10 — Borrowings:

Credit Agreement

In November 2006, we entered into a credit agreement which provided for an unsecured $1.0 billion five-year

revolving credit facility. Loans under the credit agreement bore interest at either (i) LIBOR plus a margin ranging

from 0.25 percent to 0.45 percent or (ii) a formula based on the Bank of America, or Agent’s, prime rate or on the

federal funds effective rate.

In August 2007, we entered into an amendment to our 2006 credit agreement. The amendment agreement

increased the lender commitments and borrowing capacity under the 2006 credit agreement from its prior level of

$1.0 billion to $2.0 billion, maintained an option to increase borrowing capacity by an additional $1.0 billion (after

giving effect to the $1.0 billion increase described above) and extended the maturity date by an additional year to

November 7, 2012. Lehman Brothers Commercial Bank was a participating lender in our $2.0 billion credit

agreement. As a result of the bankruptcy of its parent company, our available line of credit has been effectively

reduced by its commitment of $160 million. Loans under the amended credit agreement will bear interest at LIBOR

plus a margin ranging from 0.20 percent to 0.50 percent. Subject to certain conditions stated in the credit agreement,

we may borrow, prepay and reborrow amounts under the credit facility at any time during the term of the credit

agreement. Funds borrowed under the credit agreement may be used for working capital, capital expenditures,

acquisitions and other general corporate purposes of eBay and its subsidiaries. The credit agreement contains

customary representations, warranties, affirmative and negative covenants, including a financial covenant and

events of default. The negative covenants include restrictions regarding the incurrence of additional indebtedness

and liens, and the entry into certain agreements that restrict the ability of our subsidiaries to provide credit support.

The financial covenant requires us to meet a quarterly financial test with respect to a maximum consolidated

leverage ratio.

As of December 31, 2008, we had $1.0 billion outstanding under our credit agreement. This amount was

classified as a current liability included in our consolidated balance sheet. The interest rate at December 31, 2008

was 1.67%. As of December 31, 2008, we were in compliance with the financial covenants associated with the

credit agreement.

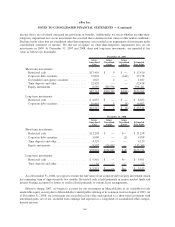

Shelf Registration Statement

At December 31, 2008, we had a shelf registration statement available which allows us to issue various types of

debt instruments, such as fixed or floating rate notes, U.S. dollar or foreign currency denominated notes,

redeemable notes, global notes, and dual currency or other indexed notes. Issuances under the shelf registration

99

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)