eBay 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

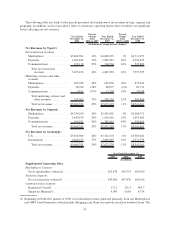

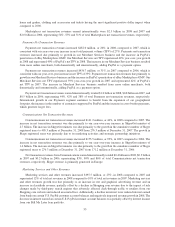

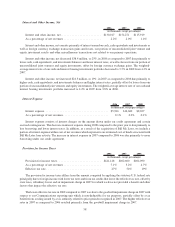

Interest and Other Income, Net

2006 2007 2008

(in thousands, except percentages)

Interest and other income, net .......................... $130,017 $154,271 $115,919

As a percentage of net revenues ........................ 2.2% 2.0% 1.4%

Interest and other income, net consists primarily of interest earned on cash, cash equivalents and investments as

well as foreign currency exchange transaction gains and losses, our portion of unconsolidated joint venture and

equity investment results and other miscellaneous transactions not related to our primary operations.

Interest and other income, net decreased $38.4 million, or 25%, in 2008 as compared to 2007 due primarily to

lower cash, cash equivalents, and investments balances and lower interest rates, as well as losses from our portion of

unconsolidated joint ventures and equity investments, offset by foreign currency exchange gains. The weighted-

average interest rate of our cash and interest bearing investments portfolio decreased to 3.5% in 2008 from 4.2% in

2007.

Interest and other income, net increased $24.3 million, or 19%, in 2007 as compared to 2006 due primarily to

higher cash, cash equivalents, and investments balances and higher interest rates, partially offset by losses from our

portion of unconsolidated joint ventures and equity investments. The weighted-average interest rate of our cash and

interest bearing investments portfolio increased to 4.2% in 2007 from 3.8% in 2006.

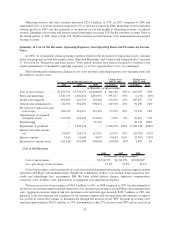

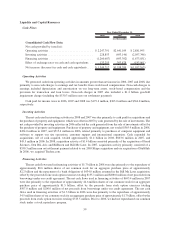

Interest Expense

2006 2007 2008

(in thousands, except percentages)

Interest expense ........................................ $5,916 $16,600 $8,037

As a percentage of net revenues............................. 0.1% 0.2% 0.1%

Interest expense consists of interest charges on the amount drawn under our credit agreement and certain

accrued contingencies. The decrease in interest expense during 2008 compared to the prior year is due primarily to

less borrowing and lower interest rates. In addition, as a result of the acquisition of Bill Me Later, we include a

portion of interest expense within cost of net revenues which represents our estimated cost of funds associated with

Bill Me Later loan activity. The increase in interest expense in 2007 compared to 2006 was due primarily to more

borrowing under our credit agreement.

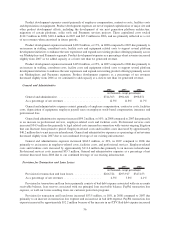

Provision for Income Taxes

2006 2007 2008

(in thousands, except percentages)

Provision for income taxes ............................ $421,418 $402,600 $404,090

As a percentage of net revenues ........................ 7.1% 5.2% 4.7%

Effective tax rate ................................... 27% 54% 19%

The provision for income taxes differs from the amount computed by applying the statutory U.S. federal rate

principally due to foreign income with lower tax rates and from tax credits that lower the effective tax rate, offset by

state taxes, subsidiary losses and an impairment charge in 2007 for which we have not provided a benefit and other

factors that impact the effective tax rate.

The lower effective tax rate in 2008 compared to 2007 was due to the goodwill impairment charge in 2007 with

respect to our Communications reporting unit which is non-deductible for tax purposes, partially offset by a tax

benefit from a ruling issued by a tax authority related to prior periods recognized in 2007. The higher effective tax

rates in 2007 as compared to 2006 resulted primarily from the goodwill impairment charge in 2007.

58