eBay 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

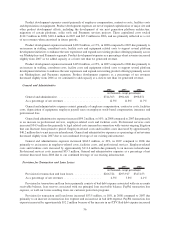

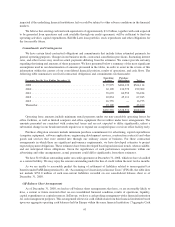

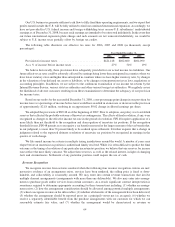

grant-date fair value of stock options granted during 2006, 2007 and 2008 was $10.47, $10.60 and $7.46 per share,

respectively, using the Black-Scholes model with the following weighted-average assumptions:

2006 2007 2008

Year Ended December 31,

Risk-free interest rate ................................ 4.7% 4.5% 2.3%

Expected life ...................................... 3.0years 3.5 years 3.8 years

Dividend yield ..................................... 0% 0% 0%

Expected volatility .................................. 36% 37% 34%

Our computation of expected volatility for 2006, 2007 and 2008 was based on a combination of historical and

market-based implied volatility from traded options on our stock. Our computation of expected life was determined

based on historical experience of similar awards, giving consideration to the contractual terms of the stock-based

awards, vesting schedules and expectations of future employee behavior. The interest rate for periods within the

contractual life of the award is based on the U.S. Treasury yield curve in effect at the time of grant. The estimation of

awards that will ultimately vest requires judgment, and to the extent actual results or updated estimates differ from

our current estimates, such amounts will be recorded as a cumulative adjustment in the period estimates are revised.

We consider many factors when estimating forfeitures, including employee class and historical experience.

Recent Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial

Accounting Standards (FAS) No. 141 (Revised 2007), “Business Combinations” (FAS 141(R)). FAS 141(R)

establishes principles and requirements for how an acquirer in a business combination recognizes and measures in

its financial statements the identifiable assets acquired, liabilities assumed, and any noncontrolling interests in the

acquiree, as well as the goodwill acquired. Significant changes from current practice resulting from FAS 141(R)

include the expansion of the definitions of a “business” and a “business combination.” For all business combinations

(whether partial, full or step acquisitions), the acquirer will record 100% of all assets and liabilities of the acquired

business, including goodwill, generally at their fair values; contingent consideration will be recognized at its fair

value on the acquisition date and, for certain arrangements, changes in fair value will be recognized in earnings until

settlement; and acquisition-related transaction and restructuring costs will be expensed rather than treated as part of

the cost of the acquisition. FAS 141(R) also establishes disclosure requirements to enable users to evaluate the

nature and financial effects of the business combination. FAS 141(R) applies prospectively to business combi-

nations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or

after December 15, 2008. FAS 141(R) may have an impact on our consolidated financial statements. The nature and

magnitude of the specific impact will depend upon the nature, terms, and size of the acquisitions consummated after

the effective date.

In December 2007, the FASB issued FAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements — An amendment of ARB No. 51” (FAS 160). FAS 160 amends Accounting Research Bulletin 51,

“Consolidated Financial Statements,” to establish accounting and reporting standards for the noncontrolling interest

in a subsidiary and for the deconsolidation of a subsidiary. It clarifies that a noncontrolling interest in a subsidiary,

which is sometimes referred to as minority interest, is a third-party ownership interest in the consolidated entity that

should be reported as a component of equity in the consolidated financial statements. Among other requirements,

FAS 160 requires the consolidated statement of income to be reported at amounts that include the amounts

attributable to both the parent and the noncontrolling interest. FAS 160 also requires disclosure on the face of the

consolidated statement of income of the amounts of consolidated net income attributable to the parent and to the

noncontrolling interest. FAS 160 is effective for fiscal years, and interim periods within those fiscal years, beginning

on or after December 15, 2008. Earlier adoption is not permitted. We do not believe the adoption of FAS 160 will

have a material impact on our consolidated financial statements.

In February 2008, the FASB issued Staff Position No. 157-2 (FSP 157-2), which delays the effective date of

FAS 157 one year for all nonfinancial assets and nonfinancial liabilities, except those recognized or disclosed at fair

value in the financial statements on a recurring basis. FSP 157-2 is effective for us beginning January 1, 2009. We do

not believe the adoption of FSP 157-2 will have a material impact on our consolidated financial statements.

66