eBay 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

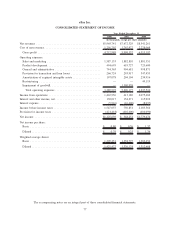

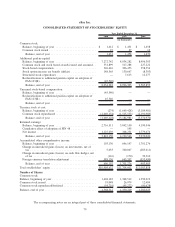

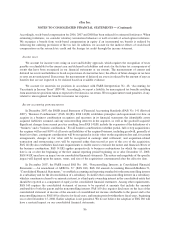

eBay Inc.

CONSOLIDATED BALANCE SHEET

December 31,

2007

December 31,

2008

(in thousands, except

par value amounts)

ASSETS

Current assets:

Cash and cash equivalents ....................................... $ 4,221,191 $ 3,188,928

Short-term investments ......................................... 676,264 163,734

Accounts receivable, net ........................................ 480,557 435,197

Loans receivable, net........................................... — 570,071

Funds receivable and customer accounts ............................ 1,513,578 1,467,962

Other current assets............................................ 230,915 460,698

Total current assets .......................................... 7,122,505 6,286,590

Long-term investments ........................................... 138,237 106,178

Property and equipment, net ....................................... 1,120,452 1,198,714

Goodwill ..................................................... 6,257,153 7,025,398

Intangible assets, net ............................................. 596,038 736,134

Other assets ................................................... 131,652 239,425

Total assets ................................................ $15,366,037 $15,592,439

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable ............................................. $ 156,613 $ 170,332

Funds payable and amounts due to customers ........................ 1,513,578 1,467,962

Accrued expenses and other current liabilities ........................ 951,139 784,774

Deferred revenue and customer advances ............................ 166,495 181,596

Income taxes payable .......................................... 111,754 100,423

Borrowings under credit agreement ................................ 200,000 1,000,000

Total current liabilities ........................................ 3,099,579 3,705,087

Deferred and other tax liabilities, net ................................. 510,557 753,965

Other liabilities ................................................. 51,299 49,529

Total liabilities ............................................. 3,661,435 4,508,581

Commitments and contingencies (Note 11)

Stockholders’ equity:

Common stock, $0.001 par value; 3,580,000 shares authorized; 1,350,219 and

1,282,025 shares outstanding ................................... 1,458 1,470

Additional paid-in capital ....................................... 8,996,303 9,585,853

Treasury stock at cost, 107,522 and 188,200 shares .................... (3,184,981) (5,376,970)

Retainedearnings............................................. 4,190,546 5,970,020

Accumulated other comprehensive income ........................... 1,701,276 903,485

Total stockholders’ equity ..................................... 11,704,602 11,083,858

Total liabilities and stockholders’ equity........................... $15,366,037 $15,592,439

The accompanying notes are an integral part of these consolidated financial statements.

76