eBay 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

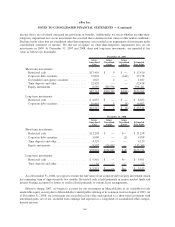

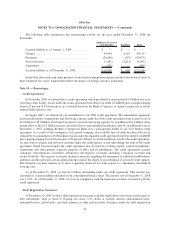

hedge accounting treatment. During the years ended December 31, 2006 and 2007, the realized gains and losses

related to these hedges were not significant. During the year ended December 31, 2008 the realized gains on these

hedges were $17.1 million. The notional amount of our economic hedges receiving cash flow hedge accounting

treatment was $428.9 million as of December 31, 2008. The gains, net of losses, recorded to accumulated other

comprehensive income as of December 31, 2008 were $40.5 million. Amounts included in accumulated other

comprehensive income at December 31, 2008 will be subsequently reclassified into the financial statements line

item in which the hedged item is recorded in the same period the forecasted transaction affects earnings.

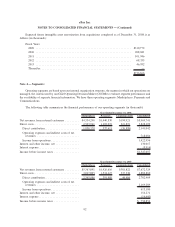

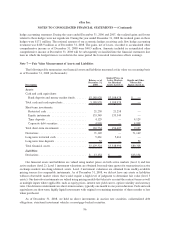

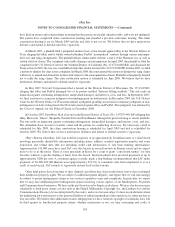

Note 7 — Fair Value Measurement of Assets and Liabilities

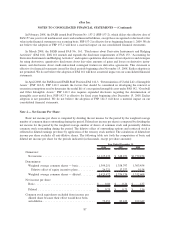

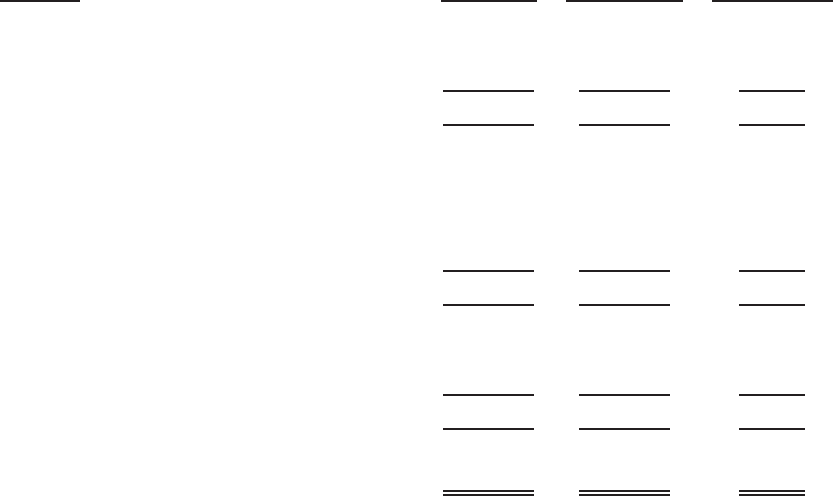

The following table summarizes our financial assets and liabilities measured at fair value on a recurring basis

as of December 31, 2008 (in thousands):

Description

Balance as of

December 31,

2008

Quoted Prices in

Active Markets

for Identical

Assets (Level 1)

Significant Other

Observable

Inputs (Level 2)

Assets:

Cash and cash equivalents:

Bank deposits and money market funds ....... $3,188,928 $3,188,928 $ —

Total cash and cash equivalents ............... 3,188,928 3,188,928 —

Short-term investments:

Restricted cash ......................... 21,258 21,258 —

Equity instruments ...................... 133,349 133,349 —

Time deposits .......................... 4,129 — 4,129

Corporate debt securities .................. 4,998 — 4,998

Total short-term investments ................. 163,734 154,607 9,127

Derivatives.............................. 71,149 — 71,149

Long-term restricted cash ................... 5,461 5,461 —

Long-term time deposits .................... 52 — 52

Total financial assets ....................... $3,429,324 $3,348,996 $80,328

Liabilities:

Derivatives.............................. $ 13,154 $ — $13,154

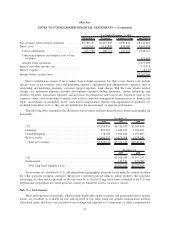

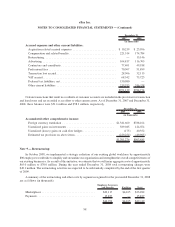

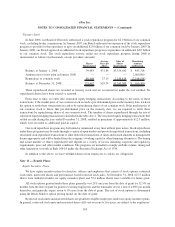

Our financial assets and liabilities are valued using market prices on both active markets (level 1) and less

active markets (level 2). Level 1 instrument valuations are obtained from real-time quotes for transactions in active

exchange markets involving identical assets. Level 2 instrument valuations are obtained from readily-available

pricing sources for comparable instruments. As of December 31, 2008, we did not have any assets or liabilities

without observable market values that would require a high level of judgment to determine fair value (level 3

assets). Our derivative instruments are valued using pricing models that take into account the contract terms as well

as multiple inputs where applicable, such as equity prices, interest rate yield curves, option volatility and currency

rates. Our derivative instruments are short-term in nature, typically one month to one year in duration. Cash and cash

equivalents are short-term, highly liquid investments with original or remaining maturities of three months or less

when purchased.

As of December 31, 2008, we held no direct investments in auction rate securities, collateralized debt

obligations, structured investment vehicles or mortgage-backed securities.

96

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)