eBay 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

at approximately $8.1 million. The fair value of StubHub stock options assumed was determined using a Black-

Scholes model. StubHub is an online marketplace that facilitates the resale of event tickets and is included within

our Marketplaces segment.

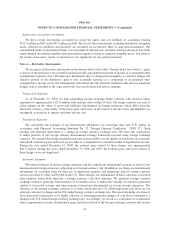

The purchase price was allocated to the tangible assets, liabilities assumed, and identifiable intangible assets

acquired based on their estimated fair values on the acquisition date. The excess of the purchase price over the

aggregate fair values was recorded as goodwill. The fair value assigned to identifiable intangible assets acquired is

determined using the income approach, which discounts expected future cash flows to present value using estimates

and assumptions determined by management. Purchased intangible assets are amortized on a straight-line basis

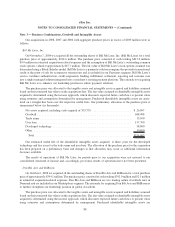

over the respective useful lives. Our allocation of the purchase price is summarized below (in thousands):

Net liabilities assumed, net of cash of $25,780 ................................ $(15,663)

Goodwill ............................................................ 221,604

Trade name .......................................................... 44,400

User base ............................................................ 29,000

Developed technology .................................................. 13,100

Total ............................................................. $292,441

Our estimated useful lives of the identifiable intangible assets acquired are three years for the trade name and

developed technology and five years for the user base.

The results of operations of StubHub for periods prior to our acquisition were not material to our consolidated

statement of income and, accordingly, pro forma results of operations have not been presented.

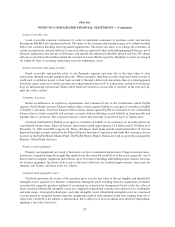

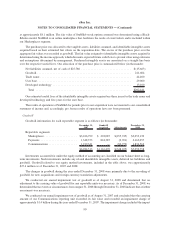

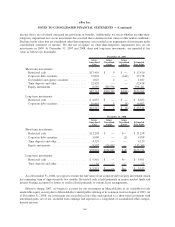

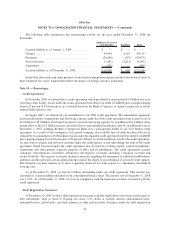

Goodwill

Goodwill information for each reportable segment is as follows (in thousands):

December 31,

2007

Goodwill

Acquired Adjustments

December 31,

2008

Reportable segments:

Marketplaces ..................... $3,016,799 $ 292,085 $(255,745) $3,053,139

Payments ....................... 1,348,373 824,385 (9,701) 2,163,057

Communications . ................. 1,919,341 — (82,779) 1,836,562

$6,284,513 $1,116,470 $(348,225) $7,052,758

Investments accounted for under the equity method of accounting are classified on our balance sheet as long-

term investments. Such investments include any related identifiable intangible assets, deferred tax liabilities and

goodwill. Goodwill related to our equity method investments, included in the table above, was approximately

$27.4 million as of December 31, 2007 and 2008.

The changes in goodwill during the year ended December 31, 2008 were primarily due to the recording of

goodwill for new acquisitions and foreign currency translation adjustments.

We conducted our annual impairment test of goodwill as of August 31, 2008 and determined that no

adjustment to the carrying value of goodwill for any reportable units was necessary. As of December 31, 2008, we

determined that no events or circumstances from August 31, 2008 through December 31, 2008 indicate that a further

assessment was necessary.

We conducted our annual impairment test of goodwill as of August 31, 2007 and concluded that the carrying

amount of our Communications reporting unit exceeded its fair value and recorded an impairment charge of

approximately $1.4 billion during the year ended December 31, 2007. The impairment charge included the impact

90

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)