eBay 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

carryforwards will begin to expire in 2020, the state net operating loss carryforwards will begin to expire in 2010. As

of December 31, 2008, our state tax credit carryforwards for income tax purposes were approximately $20.8 million.

If not utilized, the state tax credit carryforwards will begin to expire in 2015.

At December 31, 2008 and 2007, we maintained a valuation allowance with respect to certain of our deferred

tax assets relating primarily to operating losses in certain non-U.S. jurisdictions that we believe are not likely to be

realized.

We have not provided for U.S. federal income and foreign withholding taxes on $5.6 billion of non-U.S. sub-

sidiaries’ undistributed earnings as of December 31, 2008, because such earnings are intended to be indefinitely

reinvested in the operations and potential acquisitions related to our international operations. Upon distribution of

those earnings in the form of dividends or otherwise, we would be subject to U.S. income taxes (subject to an

adjustment for foreign tax credits). It is not practicable to determine the income tax liability that might be incurred if

these earnings were to be distributed.

The Company enjoys “tax holidays’’ in several different jurisdictions, most significantly Singapore and

Switzerland. The tax holidays provide for lower rates of taxation on certain classes of income and require various

thresholds of investment and employment in those jurisdictions. These tax holidays are in effect currently and

expire over periods ranging from 2011 to the duration of business operations in the respective jurisdictions.

On January 1, 2007, we adopted the provisions of FIN 48. The adoption of FIN 48 resulted in a $145,000

adjustment to beginning retained earnings.

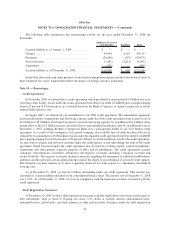

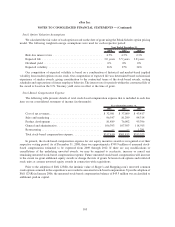

The following table reflects changes in the unrecognized tax benefits since January 1, 2007:

2007 2008

(in thousands)

Gross amounts of unrecognized tax benefits as the beginning of the

period .................................................. $385,700 $494,253

Increases related to prior year tax positions ......................... — 5,220

Increases related to current year tax positions ....................... 108,553 201,901

Gross amounts of unrecognized tax benefits as of the end of the period .... $494,253 $701,374

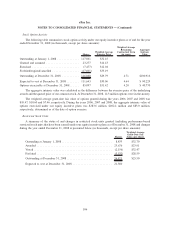

The total liabilities for unrecognized tax benefits, and the increase in these liabilities in 2008 relates primarily

to the allocations of revenue and costs among our global operations. Our liabilities for unrecognized tax benefits are

recorded as deferred and other tax liabilities, net in our consolidated balance sheet. If recognized, the portion of

liabilities for unrecognized tax benefits that would decrease our provision for income taxes and increase our net

income is $694.9 million. The impact on net income reflects the liabilities for unrecognized tax benefits net of

certain deferred tax assets and the federal tax benefit of state income tax items.

Over the next twelve months, our existing tax positions will continue to generate an increase in liabilities for

unrecognized tax benefits. We recognize interest and/or penalties related to uncertain tax positions in income tax

expense. The amount of interest and penalties accrued as of December 31, 2007 and 2008 was approximately

$16.3 million and $52.6 million, respectively. During the year, a change in California law was enacted resulting in

the accrual of $18.5 million of potential penalties.

We are subject to taxation in the U.S. and various states and foreign jurisdictions. We are under examination by

certain tax authorities for the 2003 tax year. The material jurisdictions that are subject to potential examination by

tax authorities for tax years after 2002 primarily include the U.S., California, France, Germany, Italy, Switzerland

and Singapore.

109

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)