eBay 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

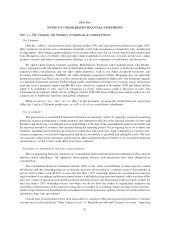

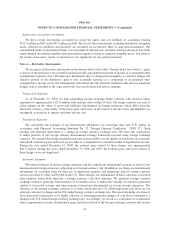

In February 2008, the FASB issued Staff Position No. 157-2 (FSP 157-2), which delays the effective date of

FAS 157 one year for all nonfinancial assets and nonfinancial liabilities, except those recognized or disclosed at fair

value in the financial statements on a recurring basis. FSP 157-2 is effective for us beginning January 1, 2009. We do

not believe the adoption of FSP 157-2 will have a material impact on our consolidated financial statements.

In March 2008, the FASB issued FAS No. 161, “Disclosures about Derivative Instruments and Hedging

Activities” (FAS 161). FAS 161 amends and expands the disclosure requirements of FAS 133, “Accounting for

Derivative Instruments and Hedging Activities” and requires qualitative disclosures about objectives and strategies

for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instru-

ments, and disclosures about credit-risk-related contingent features in derivative agreements. This statement is

effective for financial statements issued for fiscal periods beginning after November 15, 2008. Earlier adoption is

not permitted. We do not believe the adoption of FAS 161 will have a material impact on our consolidated financial

statements.

In April 2008, the FASB issued FASB Staff Position FAS 142-3, “Determination of Useful Life of Intangible

Assets” (FSP 142-3). FSP 142-3 amends the factors that should be considered in developing the renewal or

extension assumptions used to determine the useful life of a recognized intangible asset under FAS 142, “Goodwill

and Other Intangible Assets.” FSP 142-3 also requires expanded disclosure regarding the determination of

intangible asset useful lives. FSP 142-3 is effective for fiscal years beginning after December 15, 2008. Earlier

adoption is not permitted. We do not believe the adoption of FSP 142-3 will have a material impact on our

consolidated financial statements.

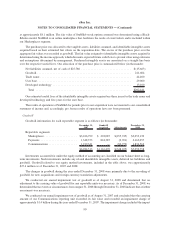

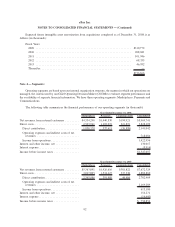

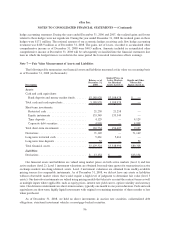

Note 2 — Net Income Per Share:

Basic net income per share is computed by dividing the net income for the period by the weighted average

number of common shares outstanding during the period. Diluted net income per share is computed by dividing the

net income for the period by the weighted average number of shares of common stock and potentially dilutive

common stock outstanding during the period. The dilutive effect of outstanding options and restricted stock is

reflected in diluted earnings per share by application of the treasury stock method. The calculation of diluted net

income per share excludes all anti-dilutive shares. The following table sets forth the computation of basic and

diluted net income per share for the periods indicated (in thousands, except per share amounts):

2006 2007 2008

Year Ended December 31,

Numerator:

Net income ................................. $1,125,639 $ 348,251 $1,779,474

Denominator:

Weighted average common shares — basic .......... 1,399,251 1,358,797 1,303,454

Dilutive effect of equity incentive plans ........... 26,221 17,377 9,154

Weighted average common shares — diluted ......... 1,425,472 1,376,174 1,312,608

Net income per share:

Basic ...................................... $ 0.80 $ 0.26 $ 1.37

Diluted .................................... $ 0.79 $ 0.25 $ 1.36

Common stock equivalents excluded from income per

diluted share because their effect would have been

anti-dilutive................................. 73,651 83,422 102,642

87

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)