eBay 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

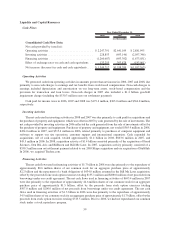

Liquidity and Capital Resources

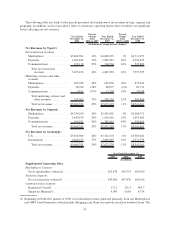

Cash Flows

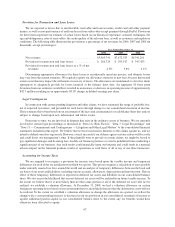

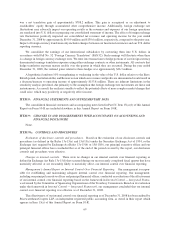

2006 2007 2008

Year Ended December 31,

(in thousands)

Consolidated Cash Flow Data:

Net cash provided by (used in):

Operating activities ............................ $2,247,791 $2,641,109 $ 2,881,995

Investing activities ............................. 228,853 (693,146) (2,057,346)

Financing activities ............................ (1,260,687) (693,392) (1,673,851)

Effect of exchange rates on cash and cash equivalents . . 133,255 303,828 (183,061)

Net increase (decrease) in cash and cash equivalents.... $1,349,212 $1,558,399 $(1,032,263)

Operating Activities

We generated cash from operating activities in amounts greater than net income in 2006, 2007 and 2008, due

primarily to non-cash charges to earnings and tax benefits from stock-based compensation. Non-cash charges to

earnings included depreciation and amortization on our long-term assets, stock-based compensation and the

provision for transaction and loan losses. Non-cash charges in 2007 also included a $1.4 billion goodwill

impairment charge (including the $530.3 million earn out settlement payment).

Cash paid for income taxes in 2006, 2007 and 2008 was $179.2 million, $363.0 million and $366.8 million,

respectively.

Investing Activities

The net cash used in investing activities in 2008 and 2007 was due primarily to cash paid for acquisitions and

the purchase of property and equipment, which was offset in 2007 by cash generated by the sale of investments. The

net cash provided by investing activities in 2006 reflected the cash generated from the sale of investments offset by

the purchase of property and equipment. Purchases of property and equipment, net totaled $565.9 million in 2008,

$454.0 million in 2007, and $515.4 million in 2006, related primarily to purchases of computer equipment and

software to support our site operations, customer support and international expansion. Cash expended for

acquisitions, net of cash acquired, totaled approximately $1.4 billion in 2008, $863.6 million in 2007, and

$45.5 million in 2006. In 2008, acquisition activity of $1.4 billion consisted primarily of the acquisition of Fraud

Sciences, Den Bla

˚Avis and BilBasen and Bill Me Later. In 2007, acquisition activity primarily consisted of a

$530.3 million earn out settlement payment related to our 2005 Skype acquisition and our acquisition of StubHub.

In 2006, we acquired Tradera.com.

Financing Activities

The net cash flows used in financing activities of $1.7 billion in 2008 were due primarily to the repurchase of

approximately 80.6 million shares of our common stock for an aggregate purchase price of approximately

$2.2 billion and the repayment of a bank obligation of $434.0 million assumed in the Bill Me Later acquisition,

offset by the proceeds from stock option exercises totaling $135.1 million and $800.0 million of net proceeds from

borrowings under our credit agreement. The net cash flows used in financing activities of $693.4 million in 2007

were due primarily to the repurchase of approximately 44.6 million shares of our common stock for an aggregate

purchase price of approximately $1.5 billion, offset by the proceeds from stock option exercises totaling

$507.0 million and $200.0 million of net proceeds from borrowings under our credit agreement. The net cash

flows used in financing activities of $1.3 billion in 2006 were due primarily to the repurchase of approximately

54.5 million shares of our common stock for an aggregate purchase price of approximately $1.7 billion, offset by the

proceeds from stock option exercises totaling $313.5 million. Prior to 2006, we had not repurchased our common

stock under a stock repurchase program.

59