eBay 2008 Annual Report Download - page 92

Download and view the complete annual report

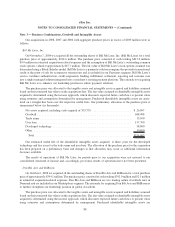

Please find page 92 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We evaluate goodwill, at a minimum, on an annual basis and whenever events and changes in circumstances

suggest that the carrying amount may not be recoverable. Impairment of goodwill is tested at the reporting unit level

by comparing the reporting unit’s carrying amount, including goodwill, to the fair value of the reporting unit. The

fair values of the reporting units are estimated using an income and discounted cash flow approach. If the carrying

amount of the reporting unit exceeds its fair value, goodwill is considered impaired and a second step is performed

to measure the amount of impairment loss, if any.

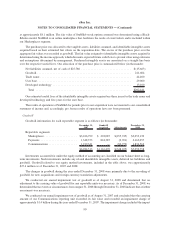

Impairment of long-lived assets

We evaluate long-lived assets (including intangible assets) for impairment whenever events or changes in

circumstances indicate that the carrying amount of a long-lived asset may not be recoverable. An asset is considered

impaired if its carrying amount exceeds the future net cash flow the asset is expected to generate. If an asset is

considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying

amount of the asset exceeds its fair market value. We assess the recoverability of our long-lived and intangible assets

by determining whether the unamortized balances can be recovered through undiscounted future net cash flows of

the related assets. The amount of impairment, if any, is measured using fair market values which are estimated based

on projected discounted future net cash flows.

Revenue recognition

Revenues are recognized when evidence of an arrangement exists, the fee is fixed and determinable, no

significant obligation remains and collection of the receivable is reasonably assured. When a revenue agreement

involves multiple elements, such as sales of various services in one arrangement or potentially multiple arrange-

ments, the entire fee from the arrangement is allocated to each respective element based on its relative fair value and

recognized when the revenue recognition criteria for each element is met. In the absence of fair value for a delivered

element, we first allocate revenue to the fair value of the undelivered elements and the residual revenue to the

delivered elements. Where the fair value for an undelivered element cannot be determined, we defer revenue

recognition for the delivered elements until the undelivered elements are delivered or the fair value is determinable.

We evaluate whether payments made to customers or revenues earned from vendors have a separate identifiable

benefit and whether they are fairly valued in determining the appropriate classification of the related revenues and

expense.

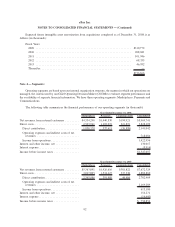

Our Marketplaces segment generates net transaction revenues primarily from listing and final value fees paid

by sellers. Listing fee revenues are recognized ratably over the estimated period of the listing, while revenues

related to final value fees are recognized at the time that the transaction is successfully concluded. A transaction is

considered successfully concluded when at least one buyer has bid above the seller’s specified minimum price or

reserve price, whichever is higher, at the end of the transaction term.

Our Payments segment earns transaction revenues primarily from processing transactions for certain cus-

tomers. Revenues resulting from a payment processing transaction are recognized once the transaction is complete.

Our Communications segment transaction revenues are generated primarily from fees charged to users to

connect Skype’s VoIP product to traditional telecommunication networks. These fees are recognized when the

service is provided. The majority of Communications segment transaction revenues are prepaid. We record

customer advances for prepaid amounts in excess of revenues recognized as a current liability.

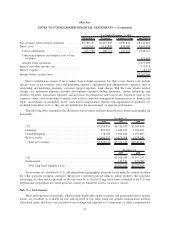

Our marketing services and other revenues, included in all of our segments, are derived principally from the

sale of advertisements, revenue sharing arrangements, classifieds fees, lead referral fees and other revenues. Our

advertising revenues are derived principally from the sale of online advertisements. To date, the duration of our

advertising contracts has ranged from one week to five years, but is generally one week to one year. Advertising

revenues on contracts are recognized as “impressions” (i.e., the number of times that an advertisement appears in

pages viewed by users of our websites) are delivered; as “clicks” (which are generated each time users on our

84

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)