eBay 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

impacted if the underlying financial institutions fail or could be subject to other adverse conditions in the financial

markets.

We believe that existing cash and cash equivalents of approximately $3.2 billion, together with cash expected

to be generated from operations and cash available through our credit agreement, will be sufficient to fund our

operating activities, capital expenditures, Bill Me Later loan portfolio, stock repurchases and other obligations for

the foreseeable future.

Commitments and Contingencies

We have certain fixed contractual obligations and commitments that include future estimated payments for

general operating purposes. Changes in our business needs, contractual cancellation provisions, fluctuating interest

rates, and other factors may result in actual payments differing from the estimates. We cannot provide certainty

regarding the timing and amounts of these payments. We have presented below a summary of the most significant

assumptions used in our determination of amounts presented in the tables, in order to assist in the review of this

information within the context of our consolidated financial position, results of operations, and cash flows. The

following table summarizes our fixed contractual obligations and commitments (in thousands):

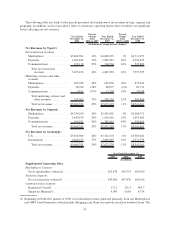

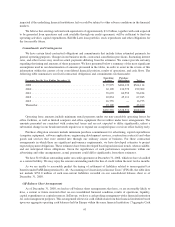

Payments Due By Year Ending December 31,

Operating

Leases

Purchase

Obligations Total

2009 ............................................ $ 77,975 $486,139 $564,114

2010 ............................................ 63,190 136,772 199,962

2011 ............................................ 35,672 60,552 96,224

2012 ............................................ 22,834 45,111 67,945

2013 ............................................ 16,755 — 16,755

Thereafter ........................................ 23,109 — 23,109

$239,535 $728,574 $968,109

Operating lease amounts include minimum rental payments under our non-cancelable operating leases for

office facilities, as well as limited computer and office equipment that we utilize under lease arrangements. The

amounts presented are consistent with contractual terms and are not expected to differ significantly, unless a

substantial change in our headcount needs requires us to expand our occupied space or exit an office facility early.

Purchase obligation amounts include minimum purchase commitments for advertising, capital expenditures

(computer equipment, software applications, engineering development services, construction contracts) and other

goods and services that were entered into through our ordinary course of business. For those contractual

arrangements in which there are significant performance requirements, we have developed estimates to project

expected payment obligations. These estimates have been developed based upon historical trends, when available,

and our anticipated future obligations. Given the significance of such performance requirements within our

advertising and other arrangements, actual payments could differ significantly from these estimates.

We have $1.0 billion outstanding under our credit agreement at December 31, 2008, which we have classified

as a current liability. We may repay the amount outstanding under the line of credit within the next twelve months.

As we are unable to reasonably predict the timing of settlement of liabilities related to unrecognized tax

benefits under FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (FIN 48), the table does

not include $754.0 million of such non-current liabilities recorded on our consolidated balance sheet as of

December 31, 2008.

Off-Balance Sheet Arrangements

As of December 31, 2008, we had no off-balance sheet arrangements that have, or are reasonably likely to

have, a current or future material effect on our consolidated financial condition, results of operations, liquidity,

capital expenditures or capital resources. In Europe, we have a cash pooling arrangement with a financial institution

for cash management purposes. This arrangement allows for cash withdrawals from this financial institution based

upon our aggregate operating cash balances held in Europe within the same financial institution (“Aggregate Cash

61