eBay 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

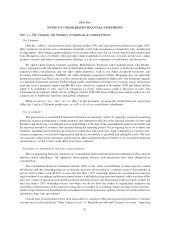

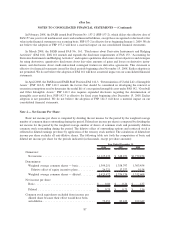

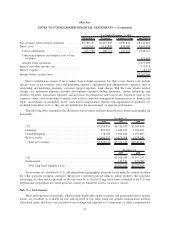

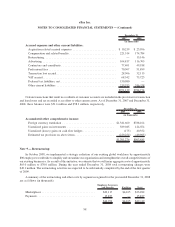

amortized on a straight-line basis over the respective useful lives. Our preliminary allocation of the purchase price is

summarized below (in thousands):

Net liabilities assumed, net of cash acquired of $3,957 .......................... $(31,612)

Goodwill ............................................................ 281,610

Trade name .......................................................... 74,100

User base ............................................................ 56,800

Developed technology .................................................. 13,200

Total ............................................................. $394,098

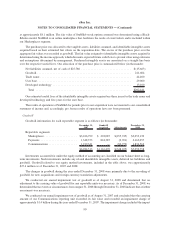

Our estimated economic life of the identifiable intangible assets acquired is three years for the developed

technology and five years for the trade name and user base. The allocation of the purchase price for the acquisition

has been prepared on a preliminary basis and changes to that allocation may occur as additional information

becomes available.

The results of operations of Den Bla

˚Avis and BilBasen for periods prior to our acquisition were not material to

our consolidated statement of income and, accordingly, pro forma results of operations have not been presented.

Fraud Sciences Ltd.

On January 30, 2008, we acquired all of the outstanding shares of Fraud Sciences Ltd. (“Fraud Sciences”) for a

total aggregate purchase price of approximately $153.6 million. The purchase price consisted of cash totaling

$148.3 million, $0.9 million in estimated acquisition-related expenses and the assumption of Fraud Sciences’

outstanding common stock options, valued at approximately $4.4 million. The fair value of Fraud Sciences’ stock

options assumed was determined using a Black-Scholes model. Fraud Sciences provides online risk management

tools and is included within our Payments segment. The rationale for acquiring Fraud Sciences is to enhance

PayPal’s proprietary fraud management systems and accelerate our development of next generation fraud detection

tools.

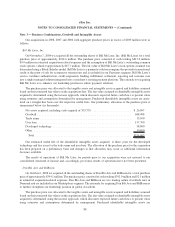

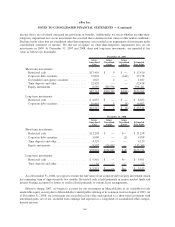

The purchase price was allocated to the tangible assets and intangible assets acquired and liabilities assumed

based on their estimated fair values on the acquisition date. The excess of the purchase price over the aggregate fair

values was recorded as goodwill. The fair value assigned to identifiable intangible assets acquired is determined

using the income approach, which discounts expected future cash flows to present value using estimates and

assumptions determined by management. Purchased intangible assets are amortized on a straight-line basis over the

respective useful lives. Our allocation of the purchase price is summarized below (in thousands):

Net liabilities assumed, net of cash acquired of $198 ............................ $ (5,117)

Goodwill ............................................................ 135,477

Developed technology .................................................. 23,200

Total ............................................................. $153,560

Our estimated useful life of the identifiable intangible assets is two years for the developed technology.

The results of operations of Fraud Sciences for periods prior to our acquisition were not material to our

consolidated statement of income and, accordingly, pro forma results of operations have not been presented.

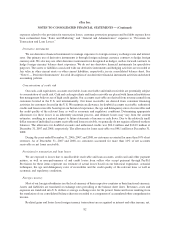

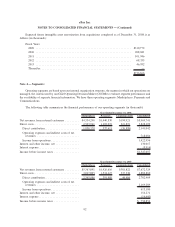

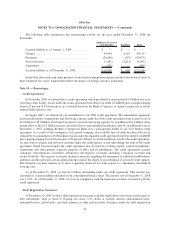

StubHub, Inc.

On February 13, 2007, we acquired all of the outstanding shares of StubHub, Inc. (“StubHub”) for a total

purchase price of $292.4 million. The purchase price was comprised of cash totaling $283.2 million, $1.1 million in

estimated acquisition-related expenses and the assumption of StubHub’s outstanding common stock options, valued

89

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)