eBay 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.volatility. Accordingly, our future results could be materially adversely impacted by changes in these or other

factors.

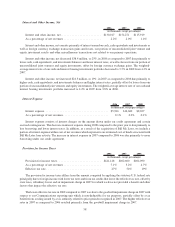

Our primary foreign currency exposures are transaction, economic and translation:

Transaction Exposure

Around the world, we have various assets and liabilities, primarily receivables, investments and accounts

payable (including inter-company transactions) that are denominated in currencies other than the relevant entity’s

functional currency. In certain circumstances, changes in the functional currency value of these assets and liabilities

create fluctuations in our reported consolidated financial position, results of operations and cash flows. We may

enter into foreign exchange contracts or other instruments to minimize the short-term foreign currency fluctuations

on such assets and liabilities. The gains and losses on the foreign exchange contracts offset the transaction gains and

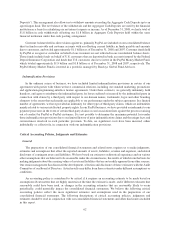

losses on certain foreign currency receivables, investments and payables recognized in earnings. As of Decem-

ber 31, 2008, we had outstanding foreign exchange hedge contracts with notional values equivalent to approx-

imately $132.4 million with maturity dates within 34 days. Transaction gains and losses on the contracts and the

assets and liabilities are recognized each period in interest and other income, net included in our consolidated

statement of income.

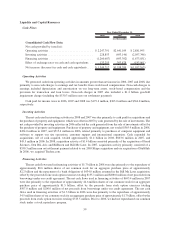

Economic Exposure

We transact business in various foreign currencies and have significant international revenues as well as costs

denominated in foreign currencies, subjecting us to foreign currency risks. In addition, we charge our international

subsidiaries on a monthly basis for their use of intellectual property and technology and for certain corporate

services provided by eBay and by PayPal. These charges are denominated in Euros and these forecasted inter-

company transactions represent a foreign currency cash flow exposure. We purchase foreign exchange contracts,

generally with maturities of 12 months or less, to reduce the volatility of cash flows related primarily to forecasted

revenue and intercompany transactions denominated in certain foreign currencies. The objective of the foreign

exchange contracts is to better ensure that the U.S. dollar-equivalent cash flows are not adversely affected by

changes in the U.S. dollar/foreign currency exchange rate. Pursuant to Financial Accounting Standards No. 133

“Accounting for Derivative Instruments and Hedging Activities” (FAS 133), we expect the hedge of certain of these

forecasted transactions to be highly effective in offsetting potential changes in cash flows attributed to a change in

the U.S. dollar/foreign currency exchange rate. Accordingly, the effective portion of the derivative’s gain or loss is

initially reported as a component of accumulated other comprehensive income (loss) and subsequently reclassified

into the financial statements line item in which the hedged item is recorded in the same period the forecasted

transaction affects earnings.

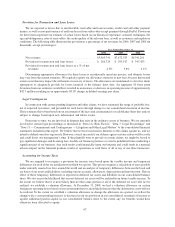

During the year ended December 31, 2008 the realized gains on these hedges were $17.1 million. During the

years ended December 31, 2007 and 2006, the realized gains and losses related to these hedges were not significant.

The notional amount of our economic hedges designated for hedge accounting treatment was $428.9 million and

$515.7 as of December 31, 2008 and 2007, respectively. As of December 31, 2008, net of losses, our unrealized

gains related to economic hedges recorded to accumulated other comprehensive income was $40.5 million. The

loss, net of gains, recorded to accumulated other comprehensive income as of December 31, 2007 was not

significant. We did not have any economic hedges in place as of December 31, 2006.

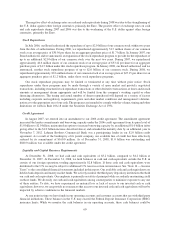

Translation Exposure

As our international operations grow, fluctuations in the foreign currencies create volatility in our reported

results of operations because we are required to consolidate the results of operations of our foreign currency

denominated subsidiaries. We may decide to purchase foreign exchange contracts or other instruments to offset the

earnings impact of currency fluctuations. Such contracts will be marked-to-market on a monthly basis and any

unrealized gain or loss will be recorded in interest and other income, net.

Foreign exchange rate fluctuations may adversely impact our financial position as the assets and liabilities of

our foreign operations are translated into U.S. dollars in preparing our consolidated balance sheet. The cumulative

effect of foreign exchange rate fluctuations on our consolidated financial position at the end of December 31, 2008,

68